Rising Demand for Automation

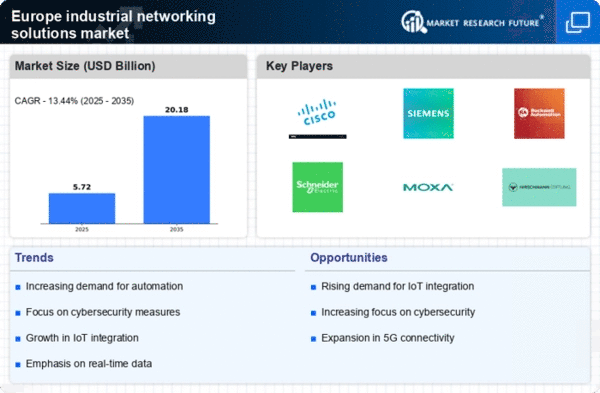

The industrial networking-solutions market in Europe experiences a notable surge in demand for automation technologies. This trend is driven by the need for enhanced operational efficiency and productivity across various sectors, including manufacturing and logistics. As companies strive to optimize their processes, the integration of advanced networking solutions becomes essential. According to recent data, the automation sector in Europe is projected to grow at a CAGR of approximately 8% from 2025 to 2030. This growth is likely to propel the adoption of industrial networking solutions, as businesses seek to implement smart factories and interconnected systems that facilitate real-time data exchange and decision-making. Consequently, the industrial networking-solutions market is poised to benefit significantly from this increasing focus on automation, as organizations invest in technologies that streamline operations and reduce costs.

Emphasis on Energy Efficiency

The industrial networking-solutions market in Europe is increasingly driven by an emphasis on energy efficiency and sustainability. As environmental concerns gain prominence, industries are seeking solutions that not only enhance productivity but also reduce energy consumption. The European Union has set ambitious targets for reducing greenhouse gas emissions, which has prompted companies to adopt energy-efficient technologies. Recent data indicates that the energy efficiency market in Europe is projected to grow at a CAGR of 7% through 2030. This growth is likely to influence the industrial networking-solutions market, as businesses invest in networking solutions that enable better monitoring and management of energy usage. By integrating energy-efficient practices, organizations can achieve cost savings while contributing to sustainability goals, thereby driving demand for advanced industrial networking solutions.

Growing Need for Data Analytics

The industrial networking-solutions market in Europe is increasingly shaped by the growing need for data analytics capabilities. As industries generate vast amounts of data, the ability to analyze and derive insights from this information becomes crucial for maintaining a competitive edge. Companies are investing in networking solutions that enable real-time data collection and analysis, facilitating informed decision-making processes. Recent studies indicate that the data analytics market in Europe is expected to reach €50 billion by 2025, with a significant portion of this growth attributed to industrial applications. This trend suggests that the industrial networking-solutions market will likely experience heightened demand for solutions that support data-driven strategies, as organizations seek to leverage analytics for operational improvements and innovation.

Expansion of Smart Manufacturing

The industrial networking-solutions market in Europe is significantly influenced by the expansion of smart manufacturing initiatives. As industries embrace the concept of Industry 4.0, there is a growing emphasis on interconnected systems that leverage data analytics and real-time monitoring. This shift is expected to drive the demand for robust networking solutions that can support the seamless integration of machines, sensors, and software. Recent statistics indicate that the smart manufacturing market in Europe is anticipated to reach €200 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 10%. This growth underscores the necessity for advanced industrial networking solutions that can facilitate communication and data sharing among various components of the manufacturing ecosystem. Thus, the industrial networking-solutions market stands to gain from the ongoing transformation towards smarter production processes.

Increased Investment in Infrastructure

The industrial networking-solutions market in Europe is witnessing a substantial increase in investment aimed at upgrading and expanding infrastructure. Governments and private entities are recognizing the importance of modernizing industrial networks to support advanced technologies and improve overall efficiency. Recent reports suggest that infrastructure spending in Europe is projected to exceed €500 billion by 2027, with a significant portion allocated to enhancing industrial connectivity. This investment is likely to create opportunities for the industrial networking-solutions market, as companies seek to implement state-of-the-art networking solutions that can accommodate the growing demands of digital transformation. Enhanced infrastructure not only facilitates better communication but also supports the integration of emerging technologies, thereby driving the overall growth of the industrial networking-solutions market.