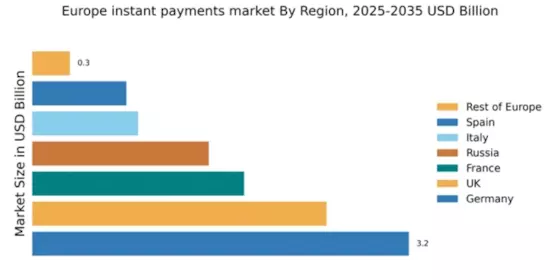

Germany : Germany's Dominance in Digital Transactions

Germany holds a commanding market share of 3.2% in the instant payments sector, driven by a robust economy and high consumer adoption rates. Key growth drivers include the increasing preference for digital transactions, supported by government initiatives promoting cashless payments. Regulatory frameworks are evolving to enhance security and efficiency, while significant investments in fintech infrastructure are fostering innovation and accessibility in payment solutions.

UK : Innovation and Competition Define the Market

The UK instant payments market, with a share of 2.5%, is characterized by rapid innovation and a competitive landscape. Growth is fueled by the rise of fintech companies and consumer demand for seamless payment experiences. Regulatory bodies are actively promoting digital payment solutions, while the UK's strong banking infrastructure supports diverse payment methods, including mobile wallets and peer-to-peer transfers. The trend towards contactless payments is also gaining traction.

France : Balancing Tradition and Innovation

France commands a 1.8% share in the instant payments market, driven by a blend of traditional banking and innovative fintech solutions. The government is actively promoting digital payment adoption through initiatives like the 'France Num' program, aimed at supporting small businesses. Consumer preferences are shifting towards mobile payments, with Paris emerging as a key market for digital transactions, supported by a strong regulatory framework that encourages competition and security.

Russia : Emerging Trends in Instant Payments

With a market share of 1.5%, Russia's instant payments sector is rapidly evolving, driven by increasing smartphone penetration and a young, tech-savvy population. Government initiatives aimed at enhancing digital infrastructure are pivotal in this growth. The competitive landscape features local players like Yandex.Money and international firms, with Moscow being a central hub for digital transactions. The demand for cross-border payments is also on the rise, reflecting a growing global integration.

Italy : Cultural Shift Towards Cashless Solutions

Italy's instant payments market, holding a 0.9% share, is experiencing a cultural shift towards cashless transactions. Government policies promoting digitalization, such as tax incentives for electronic payments, are key growth drivers. Major cities like Milan and Rome are leading in adoption rates, with a growing number of merchants accepting digital payments. The competitive landscape includes both local and international players, fostering a dynamic environment for innovation in payment solutions.

Spain : Catalonia and Madrid Lead the Charge

Spain's instant payments market, with a share of 0.8%, is witnessing rapid adoption driven by consumer demand for convenience and speed. The government is actively supporting digital payment initiatives, particularly in urban areas like Madrid and Barcelona. The competitive landscape features both established banks and emerging fintech companies, creating a vibrant ecosystem. Local businesses are increasingly adopting mobile payment solutions, reflecting changing consumer preferences towards digital transactions.

Rest of Europe : Fragmented Markets with Unique Dynamics

The Rest of Europe holds a modest market share of 0.32% in instant payments, characterized by diverse regulatory environments and varying consumer behaviors. Growth is driven by localized fintech innovations and government initiatives aimed at enhancing digital payment infrastructure. Countries like Sweden and the Netherlands are leading in adoption rates, with a focus on security and efficiency. The competitive landscape is fragmented, with both local and international players vying for market share.