Enhanced Safety Regulations

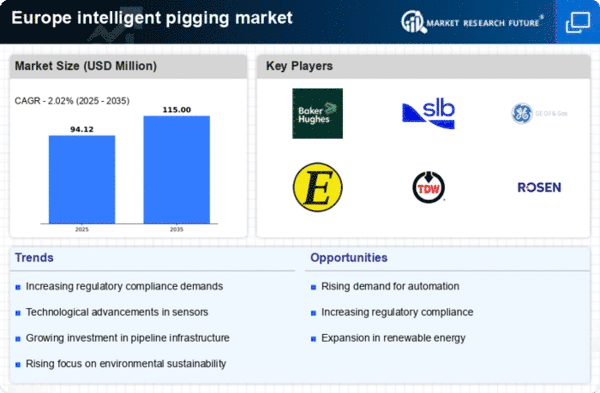

The implementation of enhanced safety regulations across Europe is a significant driver for the intelligent pigging market. Regulatory bodies are increasingly mandating rigorous inspection protocols to ensure the safety and reliability of pipeline systems. This has led to a heightened demand for intelligent pigging solutions that can provide comprehensive data on pipeline conditions. The market is expected to grow as companies strive to comply with these regulations, which often require advanced technologies for monitoring and reporting. As a result, the intelligent pigging market is likely to see an increase in investments, with projections indicating a market size of approximately €400 million by 2026.

Rising Environmental Concerns

Environmental sustainability is becoming increasingly critical in the intelligent pigging market. As public awareness of environmental issues grows, companies are under pressure to adopt practices that minimize their ecological footprint. Intelligent pigging technologies contribute to this goal by enabling more efficient monitoring and maintenance of pipelines, which can reduce the likelihood of spills and leaks. The European market is responding to these concerns, with a projected increase in the adoption of eco-friendly pigging solutions. This shift is likely to drive market growth, as organizations seek to align their operations with sustainability goals and regulatory requirements, potentially leading to a market expansion of 6% over the next few years.

Investment in Smart Technologies

The intelligent pigging market is experiencing a notable increase in investment in smart technologies. Companies are recognizing the potential of integrating artificial intelligence and machine learning into their pigging operations. This integration allows for real-time data analysis and predictive maintenance, which can significantly reduce downtime and operational costs. In Europe, the market for smart pigging solutions is projected to reach €500 million by 2027, reflecting a compound annual growth rate of around 10%. The adoption of these technologies not only improves the accuracy of inspections but also enhances decision-making processes, thereby driving the overall growth of the intelligent pigging market.

Growing Demand for Pipeline Integrity

The increasing focus on pipeline integrity management is a key driver for the intelligent pigging market in Europe. As aging infrastructure poses risks, operators are compelled to adopt advanced inspection technologies to ensure safety and compliance. The intelligent pigging market is witnessing a surge in demand, with estimates suggesting a growth rate of approximately 8% annually. This trend is driven by the need to prevent leaks and failures, which can lead to significant financial losses and environmental damage. Moreover, the European Union's stringent regulations on pipeline safety further amplify the necessity for effective monitoring solutions. Consequently, companies are investing in intelligent pigging technologies to enhance their operational efficiency and mitigate risks associated with pipeline operations.

Technological Integration in Asset Management

The integration of intelligent pigging technologies into broader asset management strategies is driving growth in the intelligent pigging market. Companies are increasingly recognizing the value of incorporating advanced inspection tools into their asset management frameworks. This integration allows for better tracking of pipeline conditions and facilitates proactive maintenance strategies. In Europe, the market is witnessing a shift towards holistic asset management approaches, with intelligent pigging playing a crucial role. This trend is expected to contribute to a market growth rate of around 7% over the next few years, as organizations seek to optimize their operations and extend the lifespan of their assets.