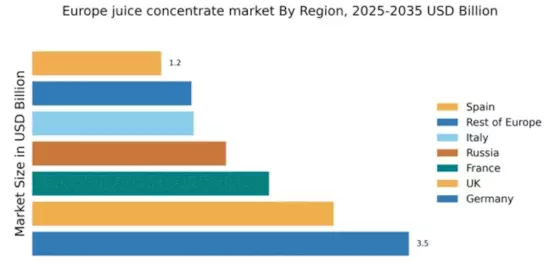

Germany : Germany's Dominance in Juice Sector

Germany holds a significant market share of 3.5% in the European juice concentrate market, valued at approximately €1.5 billion. Key growth drivers include a rising health consciousness among consumers, leading to increased demand for natural and organic juice products. Regulatory policies favoring sustainable practices and government initiatives promoting local agriculture further bolster market growth. The country’s robust infrastructure supports efficient distribution and production processes, enhancing overall market dynamics.

UK : UK's Shift Towards Healthier Options

The UK juice concentrate market accounts for 2.8% of the European total, valued at around €1.2 billion. Growth is driven by a shift towards healthier lifestyles, with consumers increasingly opting for low-sugar and organic options. The government has implemented sugar taxes to encourage healthier choices, impacting consumption patterns positively. Additionally, advancements in logistics and distribution networks have improved product availability across the nation.

France : France's Diverse Juice Market Landscape

France captures 2.2% of the European juice concentrate market, valued at approximately €950 million. The market is characterized by a strong preference for diverse juice flavors, driven by cultural consumption patterns. Government initiatives promoting local fruit production and sustainability are key growth factors. The French market also benefits from a well-established retail sector, with supermarkets and specialty stores playing a crucial role in distribution.

Russia : Russia's Expanding Juice Sector

Russia holds a 1.8% share of the European juice concentrate market, valued at about €800 million. Despite economic challenges, the demand for juice concentrates is growing, driven by urbanization and changing consumer preferences. Government support for local agriculture and food production is fostering market growth. However, regulatory hurdles and import restrictions can impact market dynamics, necessitating local sourcing strategies.

Italy : Italy's Unique Juice Offerings

Italy represents 1.5% of the European juice concentrate market, valued at around €650 million. The market thrives on its rich heritage of fruit cultivation, particularly citrus fruits. Key growth drivers include increasing demand for premium and artisanal juice products. Regulatory frameworks support organic farming, enhancing product appeal. The competitive landscape features both local producers and international brands, with regions like Sicily being pivotal for citrus juice production.

Spain : Spain's Citrus Juice Leadership

Spain accounts for 1.2% of the European juice concentrate market, valued at approximately €500 million. The country is renowned for its citrus production, particularly oranges and lemons, driving the juice concentrate sector. Growth is fueled by rising health awareness and demand for natural products. Government initiatives promoting sustainable agriculture and local sourcing are also significant. Key markets include Valencia and Andalusia, where major players like Coca-Cola and local brands compete.

Rest of Europe : Varied Juice Trends Across Europe

The Rest of Europe holds a market share of 1.48%, valued at around €600 million. This sub-region encompasses a variety of markets, each with unique preferences and consumption patterns. Growth drivers include increasing health consciousness and demand for organic products. Regulatory policies vary, impacting market dynamics differently across countries. The competitive landscape features both local and international players, with specific markets focusing on niche products and flavors.