Cultural Sensitivity and Localization

Cultural nuances play a crucial role in effective communication, prompting businesses in Europe to prioritize localization in their translation efforts. The language translation-software market is responding to this need by offering tools that not only translate text but also adapt content to resonate with local audiences. This focus on cultural sensitivity is particularly vital in marketing and advertising, where misinterpretations can lead to brand damage. As companies recognize the importance of culturally relevant messaging, the demand for advanced localization features within translation software is likely to increase. This trend suggests a potential growth trajectory for the market, as businesses seek to enhance their global reach while maintaining local relevance.

Rising Multilingual Communication Needs

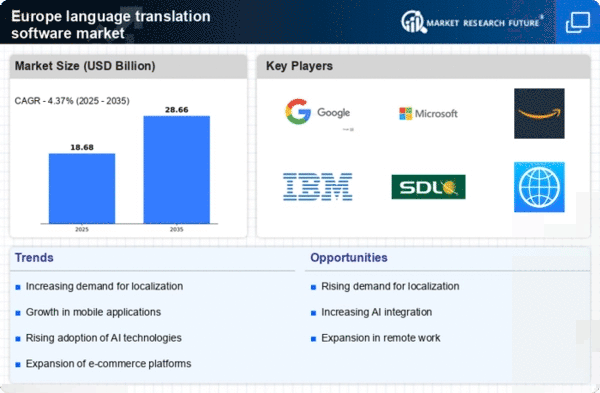

The increasing interconnectedness of businesses across Europe drives the demand for effective communication in multiple languages. As companies expand their operations internationally, the necessity for language translation-software becomes paramount. This trend is particularly evident in sectors such as e-commerce and customer service, where seamless communication can enhance customer satisfaction and retention. In 2025, the language translation-software market is projected to grow by approximately 15%, reflecting the urgency for businesses to cater to diverse linguistic audiences. Furthermore, the rise of remote work has further amplified the need for translation tools that facilitate collaboration among multilingual teams, thereby reinforcing the importance of language translation-software in fostering effective communication.

Regulatory Compliance and Standardization

In Europe, regulatory frameworks increasingly mandate the use of language translation-software to ensure compliance with local laws and standards. Industries such as healthcare, finance, and legal services are particularly affected, as accurate translations are essential for meeting regulatory requirements. The language translation-software market is likely to see a surge in demand as organizations strive to adhere to these regulations, which often necessitate precise and culturally relevant translations. For instance, the European Union's directives on consumer rights and data protection emphasize the need for clear communication in multiple languages. This regulatory landscape not only drives the adoption of translation software but also encourages innovation within the industry to meet compliance standards.

Increased Investment in Digital Transformation

The ongoing digital transformation across various sectors in Europe is a significant driver for the language translation-software market. Organizations are increasingly investing in digital tools to enhance operational efficiency and customer engagement. As part of this transformation, the integration of language translation-software becomes essential for businesses aiming to reach diverse markets. In 2025, it is anticipated that investments in digital solutions, including translation software, will rise by approximately 20%. This trend indicates a growing recognition of the value of effective communication in driving business success. Consequently, the language translation-software market is poised for substantial growth as companies prioritize digital strategies that encompass multilingual capabilities.

Technological Advancements in Translation Tools

The rapid evolution of technology significantly influences the language translation-software market in Europe. Innovations such as machine learning and neural networks enhance the accuracy and efficiency of translation tools, making them more appealing to businesses. As of 2025, the market is expected to witness a growth rate of around 12%, driven by advancements that allow for real-time translation and improved contextual understanding. These technological improvements not only streamline the translation process but also reduce costs associated with manual translation services. Consequently, businesses are increasingly adopting these sophisticated tools to maintain competitiveness in a multilingual marketplace, thereby propelling the growth of the language translation-software market.