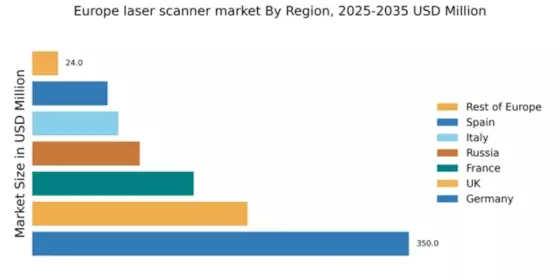

Germany : Strong Demand and Innovation Hub

Germany holds a dominant position in the European laser scanner market, accounting for 350.0 million, representing approximately 40% of the total market share. Key growth drivers include robust industrial automation, significant investments in infrastructure, and a strong emphasis on precision engineering. The demand for laser scanning technology is bolstered by government initiatives promoting digitalization and smart manufacturing, alongside stringent regulatory standards that enhance quality and safety in construction and engineering sectors. Key cities such as Berlin, Munich, and Stuttgart are pivotal markets, hosting major players like Leica Geosystems and Z+F. The competitive landscape is characterized by a mix of established firms and innovative startups, fostering a dynamic business environment. Industries such as construction, automotive, and aerospace are primary consumers of laser scanning technology, driving local demand and application diversity.

UK : Innovation and Infrastructure Development

The UK laser scanner market is valued at 200.0 million, capturing about 23% of the European market share. Growth is driven by increasing adoption in construction and surveying, alongside government investments in infrastructure projects like HS2. The demand for advanced scanning solutions is rising, supported by regulatory frameworks that encourage technological adoption in urban planning and environmental monitoring. Key markets include London, Manchester, and Birmingham, where major players like Faro Technologies and Trimble have established a strong presence. The competitive landscape is vibrant, with a mix of local and international firms. The construction and heritage sectors are significant consumers, utilizing laser scanning for both new developments and preservation projects.

France : Diverse Applications and Growth Potential

France's laser scanner market is valued at 150.0 million, representing approximately 17% of the European market share. Growth is fueled by increasing demand in sectors such as construction, architecture, and cultural heritage preservation. Government initiatives promoting digital transformation in public works and urban planning are also key drivers. Regulatory policies are increasingly supportive of innovative technologies, enhancing market potential. Key cities like Paris, Lyon, and Marseille are central to market activities, with significant contributions from players like Topcon and Riegl. The competitive landscape features both established companies and emerging startups, fostering innovation. The construction and cultural sectors are primary users, leveraging laser scanning for accurate modeling and documentation.

Russia : Industrial Expansion and Technological Adoption

The Russian laser scanner market is valued at 100.0 million, accounting for about 12% of the European market share. Key growth drivers include industrial expansion, particularly in oil and gas, and increasing investments in infrastructure. The demand for laser scanning technology is supported by government initiatives aimed at modernizing industrial processes and enhancing safety standards. Regulatory frameworks are evolving to accommodate advanced technologies. Moscow and St. Petersburg are key markets, with major players like SICK AG and Trimble having a notable presence. The competitive landscape is developing, with both local and international firms vying for market share. The oil and gas sector, along with construction, are significant consumers of laser scanning technology, driving demand for precision tools.

Italy : Cultural Heritage and Construction Focus

Italy's laser scanner market is valued at 80.0 million, representing about 9% of the European market share. Growth is driven by the need for precision in construction and the preservation of cultural heritage sites. Government initiatives supporting digitalization in construction and urban planning are key growth factors. Regulatory policies are increasingly favorable towards innovative technologies, enhancing market opportunities. Key cities such as Rome, Milan, and Florence are central to market activities, with significant contributions from players like Leica Geosystems and Creaform. The competitive landscape includes both established firms and new entrants, fostering innovation. The construction and cultural sectors are primary users, utilizing laser scanning for restoration and new projects.

Spain : Infrastructure Development and Innovation

Spain's laser scanner market is valued at 70.0 million, capturing about 8% of the European market share. Growth is driven by increasing investments in infrastructure and urban development projects. Government initiatives promoting smart cities and digital transformation are key growth drivers. Regulatory frameworks are evolving to support the adoption of advanced technologies in construction and surveying. Key markets include Madrid, Barcelona, and Valencia, where major players like Faro Technologies and Topcon are active. The competitive landscape is characterized by a mix of local and international firms. The construction and urban planning sectors are significant consumers, leveraging laser scanning for efficient project execution and management.

Rest of Europe : Diverse Applications Across Regions

The Rest of Europe laser scanner market is valued at 24.0 million, representing a smaller share of the overall market. Growth is driven by niche applications in various sectors, including construction, surveying, and environmental monitoring. Regulatory policies across different countries are increasingly supportive of technological advancements, enhancing market potential. Countries like Belgium, Netherlands, and Switzerland are key contributors, with local players and international firms like Riegl and Maptek establishing a presence. The competitive landscape varies by country, with a focus on specific applications tailored to local market needs. The construction and environmental sectors are primary users, utilizing laser scanning for diverse applications.