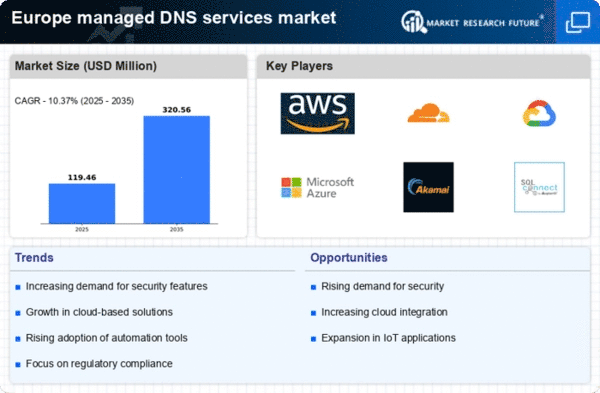

Shift Towards Cloud-Based Solutions

The managed DNS services market in Europe is significantly influenced by the ongoing shift towards cloud-based solutions. As organizations increasingly migrate their operations to the cloud, the need for scalable and flexible DNS services becomes paramount. In 2025, it is estimated that over 70% of European enterprises will utilize cloud services, creating a substantial opportunity for managed DNS providers. This transition allows businesses to leverage the benefits of cloud computing, such as enhanced scalability, cost-effectiveness, and improved performance. Managed DNS services play a crucial role in this ecosystem by ensuring high availability and low latency for cloud-hosted applications. As a result, the managed dns-services market in Europe is poised for growth as companies seek to integrate their DNS management with their cloud strategies.

Rising Internet Traffic and Connectivity

The managed DNS services market in Europe is experiencing growth driven by the increasing volume of internet traffic. As more businesses and consumers rely on online services, the demand for efficient and reliable DNS management solutions intensifies. In 2025, internet traffic in Europe is projected to reach approximately 50 exabytes per month, necessitating robust DNS services to ensure seamless connectivity. This surge in data flow compels organizations to adopt managed DNS services to enhance performance and reliability. Furthermore, the proliferation of IoT devices, which are expected to exceed 30 billion globally by 2025, further amplifies the need for scalable DNS solutions. Consequently, the managed dns-services market in Europe is likely to expand as companies seek to optimize their online presence and maintain operational efficiency amidst growing connectivity demands.

Regulatory Compliance and Data Sovereignty

The managed DNS services market in Europe is significantly shaped by regulatory compliance and data sovereignty requirements. With stringent regulations such as the General Data Protection Regulation (GDPR) in place, organizations are compelled to ensure that their DNS services comply with local data protection laws. This has led to an increased demand for managed DNS solutions that can guarantee data residency and security. In 2025, it is anticipated that compliance-related investments in Europe will exceed €10 billion, highlighting the importance of adhering to regulatory standards. As businesses navigate the complexities of data governance, the managed dns-services market in Europe is likely to see growth as companies seek providers that can offer compliant and secure DNS management.

Technological Advancements in DNS Solutions

The managed DNS services market in Europe is experiencing a transformation due to technological advancements in DNS solutions. Innovations such as DNSSEC (Domain Name System Security Extensions) and Anycast routing are enhancing the security and performance of DNS services. As organizations become more aware of cyber threats, the demand for advanced security features in DNS management is increasing. In 2025, it is projected that the adoption of DNSSEC will rise to over 40% among European businesses, reflecting a growing emphasis on securing domain name systems. These technological improvements not only bolster security but also improve the overall efficiency of DNS services. Consequently, the managed dns-services market in Europe is likely to benefit from these advancements as companies seek to enhance their digital infrastructure.

Emergence of E-Commerce and Digital Services

The managed DNS services market in Europe is bolstered by the rapid emergence of e-commerce and digital services. With online retail sales projected to surpass €500 billion in 2025, businesses are increasingly reliant on robust DNS solutions to support their digital operations. The need for high-performance DNS services is critical for e-commerce platforms to ensure fast loading times and minimize downtime, which can directly impact sales. Additionally, as more companies adopt digital transformation strategies, the demand for reliable DNS management solutions is likely to rise. This trend indicates that the managed dns-services market in Europe will continue to thrive as organizations prioritize their online presence and customer experience.