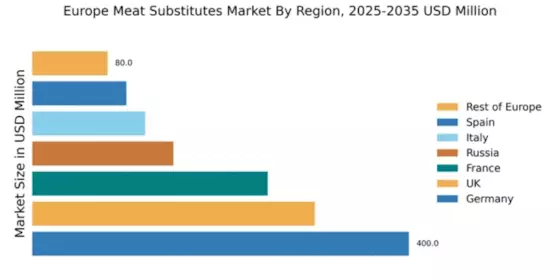

Germany : Germany's Dominance in Plant-Based Foods

Key markets include major cities like Berlin, Munich, and Hamburg, where demand for meat substitutes is particularly high. The competitive landscape features significant players such as Quorn Foods and Beyond Meat, which have established a strong presence. Local dynamics are influenced by a growing trend towards sustainability and ethical consumption. The food service industry, including restaurants and catering services, is increasingly incorporating meat substitutes into their menus, reflecting changing consumer preferences.

UK : UK's Shift Towards Meat Alternatives

Key markets include London, Manchester, and Bristol, where the demand for meat alternatives is rapidly increasing. The competitive landscape is vibrant, with major players like Quorn Foods and Beyond Meat leading the charge. Local dynamics are shaped by a strong retail presence and a burgeoning food service sector that is increasingly offering plant-based options. The rise of online grocery shopping has also facilitated access to meat substitutes, enhancing market growth.

France : France's Growing Appetite for Substitutes

Key markets include Paris, Lyon, and Marseille, where the demand for meat substitutes is on the rise. The competitive landscape features players like Beyond Meat and local brands that emphasize quality and sustainability. Local market dynamics are influenced by a strong culinary tradition that is gradually embracing plant-based options. The food service industry is adapting by incorporating meat substitutes into traditional French cuisine, enhancing their appeal to consumers.

Russia : Russia's Emerging Plant-Based Sector

Key markets include Moscow and St. Petersburg, where urban consumers are more open to trying meat substitutes. The competitive landscape is still developing, with both international players like Beyond Meat and local brands vying for market share. Local dynamics are characterized by a growing interest in health and wellness, influencing purchasing decisions. The retail sector is beginning to expand its offerings of meat alternatives, catering to the evolving preferences of consumers.

Italy : Italy's Unique Meat Substitute Market

Key markets include Milan, Rome, and Florence, where the demand for meat substitutes is growing. The competitive landscape features both international brands and local producers focusing on quality and authenticity. Local dynamics are influenced by Italy's rich culinary heritage, with restaurants increasingly incorporating meat alternatives into traditional dishes. The food service sector is adapting to consumer preferences, enhancing the appeal of plant-based options.

Spain : Spain's Expanding Meat Substitute Market

Key markets include Madrid, Barcelona, and Valencia, where the demand for meat substitutes is on the rise. The competitive landscape features both international players and local brands that emphasize quality and flavor. Local dynamics are shaped by a strong culinary tradition that is increasingly embracing plant-based options. The food service industry is adapting by incorporating meat substitutes into traditional Spanish cuisine, enhancing their appeal to consumers.

Rest of Europe : Varied Preferences Across Europe

Key markets include cities across Scandinavia, Eastern Europe, and the Benelux region, where demand for meat substitutes is growing. The competitive landscape features a mix of local and international players, each catering to unique consumer preferences. Local dynamics are influenced by cultural attitudes towards meat consumption, with some regions embracing plant-based diets more rapidly than others. The food service sector is beginning to incorporate meat substitutes into traditional dishes, enhancing their appeal.