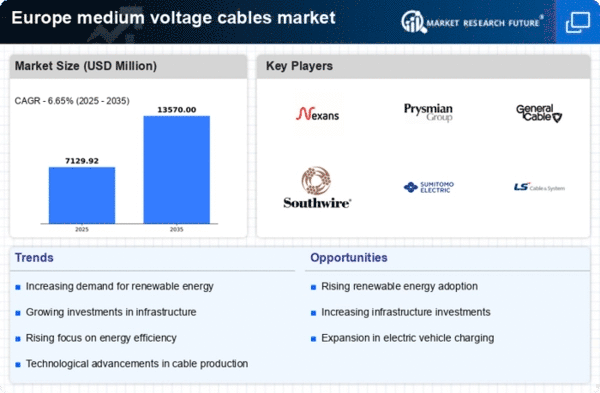

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources in Europe is driving the medium voltage-cables market. As countries strive to meet ambitious climate targets, investments in wind, solar, and hydroelectric power are surging. This shift necessitates robust medium voltage-cables to connect renewable energy plants to the grid. In 2025, the European renewable energy sector is projected to grow by approximately 15%, further amplifying the demand for medium voltage-cables. The integration of these cables is crucial for efficient energy distribution, ensuring that generated power reaches consumers effectively. Consequently, the medium voltage-cables market is likely to experience substantial growth as utilities and energy companies expand their infrastructure to accommodate this transition.

Investment in Smart Grid Technologies

The transition towards smart grid technologies is a pivotal driver for the medium voltage-cables market. European countries are increasingly investing in smart grid infrastructure to enhance energy efficiency and reliability. The European Union has allocated over €1 billion for smart grid projects in 2025, indicating a strong commitment to modernizing energy systems. Medium voltage-cables play a vital role in these smart grids, facilitating real-time data transmission and improving grid management. As utilities adopt advanced technologies, the medium voltage-cables market is likely to see a surge in demand, driven by the need for cables that can support these innovative systems.

Focus on Energy Efficiency Regulations

The increasing focus on energy efficiency regulations in Europe is a crucial driver for the medium voltage-cables market. Regulatory bodies are establishing stringent standards to reduce energy consumption and enhance the performance of electrical systems. In 2025, it is anticipated that compliance with these regulations will require significant upgrades to existing infrastructure, including the installation of high-quality medium voltage-cables. This shift is likely to create a robust demand for cables that meet or exceed energy efficiency standards. The medium voltage-cables market is expected to thrive as manufacturers innovate to produce cables that align with these evolving regulatory requirements.

Urbanization and Infrastructure Development

Urbanization trends across Europe are significantly impacting the medium voltage-cables market. As cities expand, the demand for reliable electricity distribution systems increases. The European Commission estimates that urban areas will house over 80% of the population by 2030, necessitating enhanced electrical infrastructure. This urban growth drives the need for medium voltage-cables to support new residential, commercial, and industrial developments. Furthermore, ongoing infrastructure projects, including smart city initiatives, require advanced electrical solutions. The medium voltage-cables market is poised to benefit from these developments, as utilities invest in modernizing their networks to meet the demands of urban populations.

Government Incentives for Electrical Upgrades

Government initiatives aimed at upgrading electrical infrastructure are significantly influencing the medium voltage-cables market. Various European governments are implementing policies that encourage the replacement of outdated electrical systems with modern solutions. For instance, funding programs and tax incentives are being offered to utilities and businesses that invest in new medium voltage-cables. This trend is expected to result in a market growth rate of around 10% annually through 2025. The medium voltage-cables market stands to gain from these incentives, as they promote the adoption of safer and more efficient electrical systems across the region.