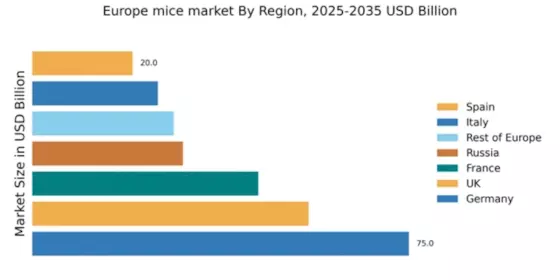

Germany : Strong Demand and Innovation Drive Growth

Key markets include Berlin, Munich, and Frankfurt, where tech hubs and gaming communities thrive. The competitive landscape features major players like Logitech, Razer, and Corsair, all vying for market share. Local dynamics are characterized by a strong preference for ergonomic and customizable mice, catering to both gamers and professionals. The presence of tech fairs and gaming events fosters a vibrant business environment, driving innovation and consumer engagement.

UK : High Demand for Gaming Peripherals

Key markets include London, Manchester, and Birmingham, where tech-savvy consumers are driving demand. The competitive landscape is dominated by players like Logitech and Razer, with a growing presence of local brands. The UK market is characterized by a preference for wireless and customizable mice, catering to gamers and professionals alike. The business environment is bolstered by a strong e-commerce sector, facilitating easy access to a wide range of products.

France : Diverse Consumer Preferences Shape Demand

Key markets include Paris, Lyon, and Marseille, where tech adoption is rapidly increasing. The competitive landscape features major players like Logitech and Microsoft, alongside local brands gaining traction. The French market is characterized by diverse consumer preferences, with a strong demand for ergonomic and stylish designs. The business environment is dynamic, supported by a growing e-commerce sector and a focus on sustainability in product offerings.

Russia : Market Expansion Driven by Youth Demographics

Key markets include Moscow and St. Petersburg, where gaming cafes and tech hubs are proliferating. The competitive landscape features major players like Razer and SteelSeries, with local brands also emerging. The Russian market is characterized by a growing preference for high-performance gaming mice, driven by the increasing popularity of eSports. The business environment is evolving, with a focus on affordability and accessibility for consumers.

Italy : Diverse Applications Fuel Market Expansion

Key markets include Milan, Rome, and Turin, where tech adoption is on the rise. The competitive landscape features major players like Logitech and Corsair, alongside local brands gaining market share. The Italian market is characterized by diverse applications, catering to both gamers and professionals. The business environment is supportive, with a growing e-commerce sector facilitating product accessibility for consumers.

Spain : Youth Engagement Drives Demand Growth

Key markets include Madrid and Barcelona, where gaming communities are thriving. The competitive landscape features major players like Logitech and HyperX, with local brands also emerging. The Spanish market is characterized by a strong demand for affordable and high-performance gaming mice, catering to the needs of both casual and professional gamers. The business environment is dynamic, supported by a growing online retail sector.

Rest of Europe : Varied Preferences Shape Regional Trends

Key markets include cities like Amsterdam, Zurich, and Vienna, where tech adoption is rapidly increasing. The competitive landscape features a mix of global players like Microsoft and local brands. The market is characterized by varied consumer preferences, with a strong demand for ergonomic and customizable mice. The business environment is evolving, supported by a growing e-commerce sector and a focus on sustainability in product offerings.