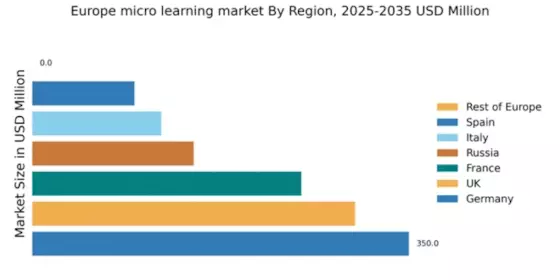

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding market share of 35% in the European micro learning sector, valued at $350.0 million. Key growth drivers include a robust digital infrastructure, increasing demand for flexible learning solutions, and a strong emphasis on upskilling in the workforce. Government initiatives, such as the Digital Strategy 2025, promote digital education and training, further enhancing market potential. The industrial landscape is evolving, with a focus on technology and innovation, fostering a conducive environment for micro learning solutions.

UK : Diverse Offerings and High Engagement

The UK micro learning market accounts for 30% of the European share, valued at $300.0 million. Growth is driven by a high demand for personalized learning experiences and the increasing adoption of mobile learning platforms. The UK government supports digital skills initiatives, enhancing accessibility to learning resources. The market is characterized by a strong emphasis on corporate training and professional development, reflecting a culture of continuous learning.

France : Emphasis on Quality and Accessibility

France captures 25% of the European micro learning market, valued at $250.0 million. The growth is fueled by a strong focus on educational reform and the integration of technology in learning. Government policies, such as the National Digital Strategy, aim to enhance digital literacy and accessibility. The demand for micro learning is particularly strong in urban areas, where businesses seek efficient training solutions to upskill employees.

Russia : Growth Potential in Diverse Sectors

Russia holds a 15% share of the European micro learning market, valued at $150.0 million. The market is driven by increasing internet penetration and a growing demand for online education. Government initiatives to promote digital education are gaining traction, fostering a supportive environment for micro learning. Key sectors include technology, finance, and healthcare, where tailored learning solutions are increasingly sought after.

Italy : Focus on Corporate Training Solutions

Italy represents 12% of the European micro learning market, valued at $120.0 million. The growth is propelled by a rising demand for corporate training and professional development. Government support for digital education initiatives is enhancing the learning landscape. Major cities like Milan and Rome are key markets, with a competitive landscape featuring both local and international players offering diverse learning solutions.

Spain : Adoption Driven by Flexibility Needs

Spain accounts for 9.5% of the European micro learning market, valued at $95.0 million. The market is experiencing growth due to the increasing need for flexible learning options among professionals. Government initiatives aimed at improving digital skills are contributing to market expansion. Key cities like Madrid and Barcelona are central to the competitive landscape, with various players offering innovative learning platforms.

Rest of Europe : Exploring New Market Opportunities

The Rest of Europe currently shows no significant market share in micro learning, valued at $0.0 million. However, there is potential for growth as digital education becomes a priority across various nations. Emerging markets are beginning to recognize the importance of micro learning for workforce development. As infrastructure improves and digital literacy increases, opportunities for market entry and expansion will arise.