Germany : Strong Demand and Innovation Hub

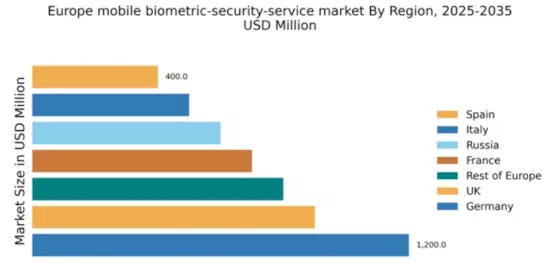

Germany holds a dominant position in the mobile biometric-security-service market, accounting for 30% of the total European market share with a value of $1,200.0 million. Key growth drivers include increasing security concerns, advancements in biometric technology, and government initiatives promoting digital identity solutions. The regulatory framework is supportive, with policies aimed at enhancing data protection and privacy, fostering a conducive environment for market expansion. Infrastructure development, particularly in urban areas, further boosts demand for biometric solutions.

UK : Innovation and Regulatory Support

The UK represents 22.5% of the European market, valued at $900.0 million. Growth is driven by rising security threats and the adoption of biometric systems in various sectors, including finance and healthcare. The UK government has implemented regulations that encourage the use of biometric technology, enhancing public trust. Demand is particularly strong in metropolitan areas like London and Manchester, where the competitive landscape features major players like IDEMIA and Thales Group, focusing on applications in identity verification and access control.

France : Diverse Applications and Growth Potential

France holds a 17.5% market share, valued at $700.0 million, driven by increasing adoption of biometric systems across public and private sectors. Key growth factors include government initiatives aimed at enhancing national security and the integration of biometric technology in smart city projects. The regulatory environment is favorable, promoting innovation while ensuring data protection. Major cities like Paris and Lyon are key markets, with significant presence from players like Gemalto and IDEMIA, focusing on applications in law enforcement and border control.

Russia : Government Initiatives Drive Growth

Russia accounts for 15% of the European market, valued at $600.0 million. The growth is fueled by government initiatives aimed at enhancing national security and public safety, alongside increasing investments in technology infrastructure. Regulatory policies are evolving to support biometric adoption, particularly in law enforcement and public services. Key markets include Moscow and St. Petersburg, where competition is intensifying with local and international players like NEC Corporation and Thales Group, focusing on applications in surveillance and identity management.

Italy : Focus on Innovation and Compliance

Italy represents 12.5% of the market, valued at $500.0 million, with growth driven by rising security concerns and the need for compliance with EU regulations. The Italian government is actively promoting the adoption of biometric technologies in various sectors, including banking and public services. Key cities like Milan and Rome are central to market activities, with a competitive landscape featuring players like IDEMIA and Crossmatch Technologies. The focus is on applications in identity verification and access control, enhancing security measures across industries.

Spain : Regulatory Support and Innovation

Spain holds a 10% market share, valued at $400.0 million, with growth driven by increasing security needs and regulatory support for biometric technology adoption. The Spanish government is implementing policies to enhance public safety, fostering a favorable environment for market growth. Key markets include Madrid and Barcelona, where competition is growing with the presence of major players like Thales Group and Aware Inc. The focus is on applications in public safety and financial services, driving demand for innovative biometric solutions.

Rest of Europe : Varied Market Dynamics and Growth

The Rest of Europe accounts for 20% of the market, valued at $800.0 million, characterized by diverse market dynamics and varying growth rates. Key growth drivers include regional security concerns and the adoption of biometric solutions in various sectors. Regulatory frameworks are evolving, with different countries implementing policies to support biometric technology. Major markets include the Nordic countries and Eastern Europe, where competition features both local and international players. Applications span across healthcare, finance, and public safety, creating a broad spectrum of opportunities.