Germany : Strong Infrastructure and Innovation

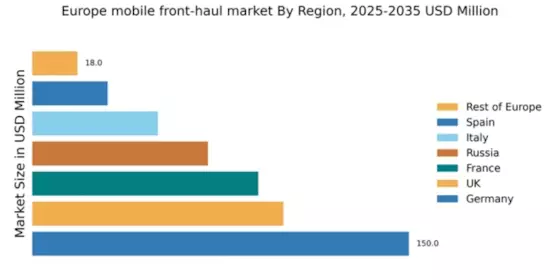

Germany holds a dominant position in the European mobile front-haul market, with a market share of 37.5% valued at $150.0 million. Key growth drivers include robust investments in 5G infrastructure, increasing demand for high-speed connectivity, and government initiatives promoting digital transformation. The regulatory environment is supportive, with policies aimed at enhancing broadband access and fostering innovation in telecommunications. Industrial development, particularly in technology hubs like Berlin and Munich, further fuels market growth.

UK : 5G Expansion and Urban Demand

The UK mobile front-haul market is valued at $100.0 million, representing 25% of the European market. Growth is driven by the rapid rollout of 5G networks and increasing urbanization, leading to higher demand for mobile data services. Government initiatives, such as the National Infrastructure Strategy, aim to enhance digital connectivity across the nation. The competitive landscape features major players like Nokia and Ericsson, particularly in cities like London and Manchester, where demand for advanced mobile services is surging.

France : Innovation and Regulatory Support

France's mobile front-haul market is valued at $90.0 million, accounting for 22.5% of the European market. Key growth drivers include government support for digital infrastructure and a strong focus on innovation in telecommunications. The regulatory framework encourages investment in 5G technology, enhancing connectivity across urban and rural areas. Major cities like Paris and Lyon are pivotal markets, with significant presence from players like Huawei and Cisco, catering to diverse sectors including smart cities and IoT applications.

Russia : Investment in Telecommunications Infrastructure

Russia's mobile front-haul market is valued at $70.0 million, representing 17.5% of the European market. Growth is driven by substantial investments in telecommunications infrastructure and increasing demand for mobile broadband services. Government initiatives focus on enhancing digital connectivity, particularly in remote areas. Key markets include Moscow and St. Petersburg, where major players like Ericsson and Huawei are actively expanding their presence, addressing the needs of various industries including energy and transportation.

Italy : Focus on 5G and Connectivity

Italy's mobile front-haul market is valued at $50.0 million, making up 12.5% of the European market. The growth is fueled by the increasing adoption of 5G technology and rising consumer demand for mobile data services. Government policies support digital transformation, with initiatives aimed at improving broadband access. Key markets include Milan and Rome, where competition among major players like Nokia and ZTE is intensifying, particularly in sectors such as automotive and smart manufacturing.

Spain : Urbanization and Technological Advancements

Spain's mobile front-haul market is valued at $30.0 million, representing 7.5% of the European market. The growth is driven by urbanization and the increasing need for high-speed mobile connectivity. Government initiatives focus on enhancing digital infrastructure, particularly in urban areas. Major cities like Madrid and Barcelona are key markets, with significant involvement from players like Cisco and Samsung, catering to sectors such as tourism and retail, which are increasingly reliant on mobile technology.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe mobile front-haul market is valued at $18.0 million, accounting for 4.5% of the overall European market. Growth varies significantly across countries, influenced by local regulations and infrastructure development. Government initiatives in smaller nations aim to enhance connectivity and support digital transformation. The competitive landscape includes regional players and global giants like Ciena and Juniper Networks, addressing specific needs in sectors such as healthcare and education, which are increasingly adopting mobile solutions.

Leave a Comment