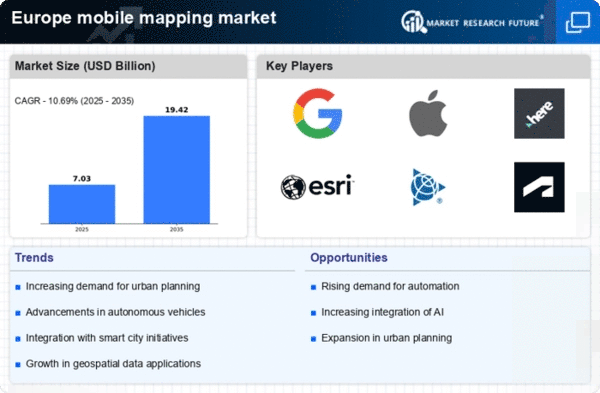

Growing Urbanization

The rapid urbanization across Europe is a pivotal driver for the mobile mapping market. As cities expand, the demand for accurate geospatial data increases, facilitating urban planning and infrastructure development. The European Commission has reported that over 70% of the population now resides in urban areas, leading to a heightened need for efficient mapping solutions. This trend necessitates the integration of mobile mapping technologies to support smart city initiatives, optimize transportation networks, and enhance public services. Consequently, the mobile mapping market is likely to experience substantial growth as municipalities seek innovative solutions to manage urban challenges effectively.

Advancements in Sensor Technology

Recent advancements in sensor technology are significantly influencing the mobile mapping market in Europe. The integration of high-resolution cameras, LiDAR, and GNSS systems has enhanced the accuracy and efficiency of mobile mapping solutions. For instance, the deployment of LiDAR-equipped vehicles has improved data collection capabilities, allowing for detailed 3D mapping of complex environments. This technological evolution is expected to drive market growth, as organizations increasingly adopt these sophisticated tools for applications in construction, transportation, and environmental monitoring. The mobile mapping market is poised to benefit from these innovations, potentially leading to a market valuation exceeding €1 billion by 2027.

Rising Demand for Autonomous Vehicles

The increasing interest in autonomous vehicles is a significant driver for the mobile mapping market in Europe. As automotive manufacturers and technology companies invest heavily in self-driving technology, the need for precise mapping data becomes paramount. Mobile mapping systems provide the necessary geospatial information to support navigation and obstacle detection for autonomous vehicles. According to industry estimates, the autonomous vehicle market in Europe is projected to reach €60 billion by 2030, creating a substantial demand for mobile mapping solutions. This trend indicates a promising future for the mobile mapping market, as it aligns with the broader shift towards automation in transportation.

Increased Investment in Infrastructure Development

The surge in infrastructure development projects across Europe is a crucial driver for the mobile mapping market. Governments and private entities are investing heavily in transportation, utilities, and public works to enhance connectivity and support economic growth. The European Investment Bank has reported a commitment of over €500 billion towards infrastructure projects in the coming years. This investment creates a demand for accurate mapping solutions to support project planning, execution, and monitoring. As a result, the mobile mapping market is expected to thrive, providing essential data and insights that facilitate the successful completion of these large-scale initiatives.

Integration with Geographic Information Systems (GIS)

The integration of mobile mapping technologies with Geographic Information Systems (GIS) is driving innovation within the mobile mapping market in Europe. This synergy allows for enhanced data analysis and visualization, enabling organizations to make informed decisions based on accurate geospatial information. As businesses and government agencies increasingly rely on GIS for planning and operational purposes, the demand for mobile mapping solutions that seamlessly integrate with these systems is expected to rise. The mobile mapping market is likely to see growth as organizations seek to leverage this integration for improved efficiency and effectiveness in various applications, including land management and environmental monitoring.