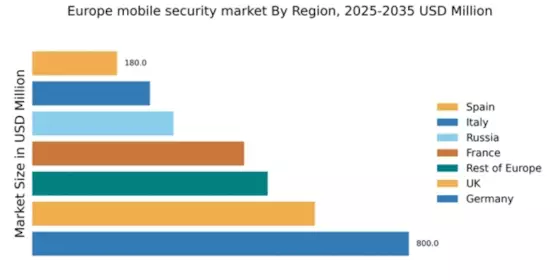

Germany : Robust Growth Driven by Innovation

Germany holds a dominant position in the European mobile security market, accounting for 32% of the total market share with a value of $800.0 million. Key growth drivers include a strong emphasis on data protection regulations, such as the GDPR, and increasing cyber threats. The demand for mobile security solutions is rising, particularly in sectors like finance and healthcare, where sensitive data is prevalent. Government initiatives promoting digital security further bolster market growth, supported by advanced infrastructure and a thriving tech ecosystem.

UK : Innovation Meets Regulatory Compliance

The UK mobile security market is valued at $600.0 million, representing 24% of the European market share. Growth is driven by increasing mobile device usage and stringent data protection laws, including the Data Protection Act. Demand for mobile security solutions is particularly high in urban centers like London and Manchester, where businesses are increasingly adopting advanced security measures. The competitive landscape features major players like Sophos and McAfee, which are well-positioned to meet the evolving needs of consumers and enterprises alike.

France : Focus on Data Privacy and Compliance

France's mobile security market is valued at $450.0 million, capturing 18% of the European market share. The growth is fueled by rising concerns over data privacy and compliance with the GDPR. Demand trends indicate a shift towards integrated security solutions, particularly in sectors like retail and telecommunications. Government initiatives aimed at enhancing cybersecurity infrastructure are also pivotal. The competitive landscape includes local players and international firms, with Paris being a key market for mobile security solutions.

Russia : Cybersecurity Amidst Evolving Threats

Russia's mobile security market is valued at $300.0 million, accounting for 12% of the European market share. The growth is driven by increasing cyber threats and a rising number of mobile users. Demand for mobile security solutions is particularly strong in major cities like Moscow and St. Petersburg. The competitive landscape features Kaspersky Lab, a local leader, alongside international players. Government initiatives to bolster cybersecurity infrastructure are also influencing market dynamics, creating a favorable business environment.

Italy : Regulatory Support and Market Growth

Italy's mobile security market is valued at $250.0 million, representing 10% of the European market share. Key growth drivers include increasing mobile device penetration and regulatory support from the Italian Data Protection Authority. Demand trends show a preference for user-friendly security solutions, particularly in sectors like finance and e-commerce. Major cities such as Milan and Rome are key markets, with a competitive landscape featuring both local and international players, fostering innovation and collaboration.

Spain : Focus on Consumer Protection

Spain's mobile security market is valued at $180.0 million, capturing 7% of the European market share. Growth is driven by rising mobile internet usage and increasing awareness of cybersecurity threats. Demand for mobile security solutions is particularly high in urban areas like Madrid and Barcelona. The competitive landscape includes local firms like Panda Security and international players. Government initiatives aimed at enhancing consumer protection and cybersecurity awareness are also shaping the market dynamics.

Rest of Europe : Varied Market Dynamics Across Regions

The Rest of Europe mobile security market is valued at $500.0 million, accounting for 20% of the total market share. Growth is driven by varying regulatory environments and increasing mobile device usage across different countries. Demand trends indicate a rising need for tailored security solutions in sectors like healthcare and finance. The competitive landscape is diverse, with both local and international players vying for market share. Key markets include Scandinavia and Eastern Europe, where government initiatives are promoting cybersecurity.