Growth of IoT Applications

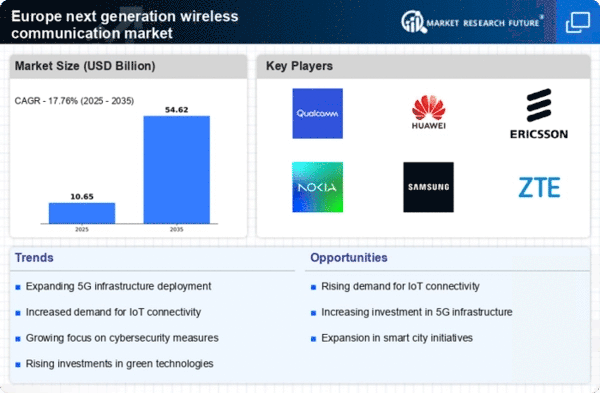

The proliferation of Internet of Things (IoT) applications is significantly influencing the next generation-wireless-communication market. In Europe, the number of connected devices is projected to reach 1 billion by 2025, creating a substantial demand for robust wireless communication networks. This growth is driven by various sectors, including smart cities, healthcare, and industrial automation, which rely on real-time data transmission. The integration of IoT with next generation wireless technologies, such as 5G, is expected to enhance operational efficiency and enable new business models. Consequently, this trend presents lucrative opportunities for stakeholders in the wireless communication sector.

Increased Focus on Cybersecurity

As the next generation-wireless-communication market evolves, the emphasis on cybersecurity has become increasingly pronounced. With the rise of sophisticated cyber threats, stakeholders are compelled to prioritize the security of wireless communication networks. In Europe, investments in cybersecurity solutions for wireless technologies are projected to grow by 20% annually. This focus on security not only protects sensitive data but also fosters consumer trust in wireless services. Moreover, regulatory frameworks are increasingly mandating robust security measures, further driving the demand for secure next generation wireless communication solutions.

Advancements in Network Technologies

Technological advancements in network infrastructure are a pivotal driver of the next generation-wireless-communication market. Innovations such as network slicing and edge computing are enhancing the capabilities of wireless networks, enabling them to support diverse applications and services. In Europe, telecom operators are investing heavily in upgrading their infrastructure to accommodate these advancements. The market for network equipment is expected to grow by 12% over the next five years, reflecting the increasing need for efficient and flexible wireless communication solutions. These advancements not only improve service quality but also pave the way for new revenue streams in the wireless communication sector.

Government Initiatives and Regulations

Government initiatives and regulations play a crucial role in shaping the next generation-wireless-communication market. In Europe, regulatory bodies are actively promoting the rollout of 5G networks, which are expected to revolutionize communication standards. The European Union has set ambitious targets for 5G deployment, aiming for widespread coverage by 2025. This regulatory push not only facilitates investment in infrastructure but also encourages innovation among telecom providers. Additionally, compliance with stringent data protection regulations, such as GDPR, is driving the development of secure wireless communication solutions, further enhancing the market landscape.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity is a primary driver in the next generation-wireless-communication market. As businesses and consumers alike seek faster internet speeds, the need for advanced wireless communication technologies becomes evident. In Europe, the number of broadband subscriptions has surged, with a reported growth of 15% in the last year alone. This trend indicates a strong market potential for next generation wireless solutions, as users expect seamless connectivity for applications such as streaming, gaming, and remote work. Furthermore, the European Commission's initiatives to enhance digital infrastructure are likely to bolster investments in this sector, thereby accelerating the adoption of next generation wireless technologies.