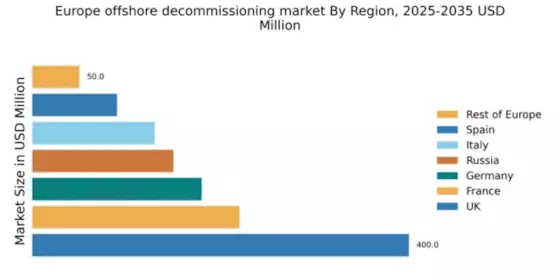

Germany : Strong regulations drive market growth

Germany holds a market value of $180.0 million, representing approximately 12.5% of the European offshore decommissioning market. Key growth drivers include stringent environmental regulations and a push for sustainable energy solutions. The demand for decommissioning services is rising as aging offshore infrastructure requires safe and efficient removal. Government initiatives, such as the Renewable Energy Sources Act, support this transition, while investments in industrial infrastructure enhance operational capabilities.

UK : Robust market with significant investments

The UK dominates the offshore decommissioning market with a value of $400.0 million, accounting for 27.8% of the total market share. The growth is fueled by the aging North Sea oil fields and increasing regulatory pressures for safe decommissioning. The UK government has implemented policies to streamline decommissioning processes, encouraging investment in technology and infrastructure. This has led to a surge in demand for specialized services and innovative solutions.

France : Investment in sustainable practices

France's offshore decommissioning market is valued at $220.0 million, representing about 15.3% of the European market. The growth is driven by increasing investments in renewable energy and the need to decommission aging oil platforms. Regulatory frameworks, such as the Energy Transition Law, promote sustainable practices, enhancing demand for decommissioning services. The market is also influenced by France's commitment to reducing carbon emissions and transitioning to greener energy sources.

Russia : Focus on safety and compliance

With a market value of $150.0 million, Russia accounts for approximately 10.4% of the European offshore decommissioning market. Key growth drivers include the need for compliance with international safety standards and environmental regulations. The Russian government is increasingly focusing on decommissioning aging offshore facilities, particularly in the Arctic region. This has led to a rise in demand for specialized services and technologies to ensure safe and efficient operations.

Italy : Regulatory changes spur growth

Italy's offshore decommissioning market is valued at $130.0 million, making up about 9.0% of the European market. The growth is driven by regulatory changes aimed at enhancing safety and environmental protection. The Italian government has introduced policies to facilitate the decommissioning of aging offshore platforms, which is expected to increase demand for specialized services. Additionally, investments in infrastructure are crucial for supporting these initiatives and ensuring compliance with EU regulations.

Spain : Focus on renewable energy transition

Spain's offshore decommissioning market is valued at $90.0 million, representing about 6.3% of the European market. The growth is primarily driven by the country's transition towards renewable energy sources and the need to decommission outdated offshore facilities. Government initiatives, such as the National Integrated Energy and Climate Plan, emphasize sustainable practices, which are expected to boost demand for decommissioning services. The market is characterized by increasing investments in technology and infrastructure.

Rest of Europe : Fragmented market with unique challenges

The Rest of Europe holds a market value of $50.0 million, accounting for about 3.5% of the total offshore decommissioning market. This sub-region presents diverse opportunities driven by varying regulatory environments and market conditions. Countries like Norway and Denmark are investing in decommissioning services, influenced by their aging offshore infrastructure. The competitive landscape includes local players and international firms, each adapting to unique local dynamics and sector-specific applications.