Rising Data Traffic

The optical network-hardware market in Europe experiences a notable surge in data traffic, driven by the increasing adoption of cloud computing and streaming services. As businesses and consumers demand higher bandwidth for applications such as video conferencing and online gaming, the need for advanced optical network solutions becomes paramount. Reports indicate that data traffic in Europe is projected to grow at a CAGR of approximately 25% over the next five years. This growth necessitates the deployment of high-capacity optical networks, which in turn propels the demand for optical network-hardware. Consequently, manufacturers are focusing on developing innovative products that can handle this escalating data load, thereby enhancing their market presence in the optical network-hardware market.

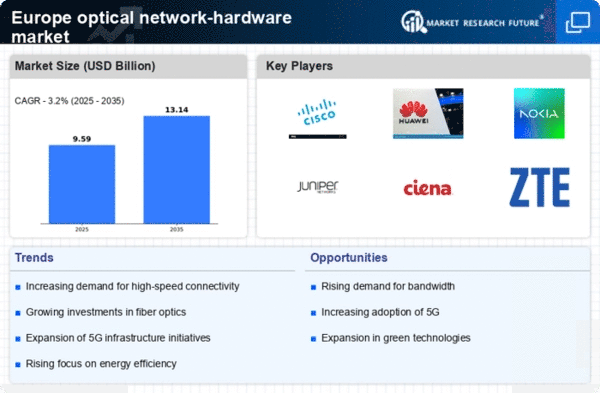

Emergence of 5G Technology

The rollout of 5G technology across Europe significantly impacts the optical network-hardware market. As telecommunications companies upgrade their infrastructure to support 5G networks, the demand for high-performance optical components increases. 5G networks require low-latency and high-capacity solutions, which optical networks are well-positioned to provide. Analysts suggest that the investment in optical network-hardware will rise sharply, with estimates indicating a potential market growth of over €10 billion by 2027. This transition not only enhances mobile connectivity but also drives the need for advanced optical technologies, thereby creating new opportunities within the optical network-hardware market.

Increased Focus on Cybersecurity

As cyber threats become more sophisticated, the optical network-hardware market in Europe is witnessing a heightened emphasis on cybersecurity measures. Organizations are increasingly aware of the vulnerabilities associated with data transmission and are seeking robust solutions to protect their networks. This trend has led to the integration of advanced security features within optical network-hardware, such as encryption and intrusion detection systems. The market for cybersecurity in optical networks is expected to grow, with estimates suggesting a CAGR of around 15% over the next few years. This focus on security not only enhances the reliability of optical networks but also boosts consumer confidence in the optical network-hardware market.

Government Initiatives and Funding

Government initiatives across Europe play a crucial role in shaping the optical network-hardware market. Various national and regional programs aim to enhance digital infrastructure, particularly in rural and underserved areas. For instance, the European Union has allocated substantial funding to improve broadband connectivity, which directly influences the demand for optical network-hardware. The European Commission's Digital Europe Programme, with a budget of €7.5 billion, aims to support the deployment of advanced digital technologies. Such initiatives not only stimulate investment in optical network infrastructure but also encourage collaboration between public and private sectors, fostering innovation within the optical network-hardware market.

Adoption of Open Networking Standards

The optical network-hardware market in Europe is experiencing a shift towards open networking standards, which promote interoperability and flexibility in network design. This trend allows service providers to mix and match hardware from different vendors, reducing costs and fostering innovation. The Open Networking Foundation and similar organizations are driving this movement, encouraging the adoption of open-source solutions. As a result, the optical network-hardware market is likely to see increased competition and a broader range of products available to consumers. This shift not only enhances the efficiency of network operations but also positions the optical network-hardware market for sustainable growth in the coming years.