Emergence of 5G Technology

The rollout of 5G technology across Europe is poised to be a major driver for the photonic integrated-circuit market. 5G networks demand higher data rates and lower latency, which photonic integrated circuits can provide. As telecommunications companies invest heavily in 5G infrastructure, the need for advanced photonic solutions becomes increasingly critical. Analysts predict that the 5G market in Europe will exceed €50 billion by 2025, creating substantial opportunities for the photonic integrated-circuit market industry. This growth is likely to stimulate innovation and collaboration among technology providers, further enhancing the capabilities of photonic integrated circuits.

Growing Demand for Data Centers

The increasing demand for data centers in Europe is significantly impacting the photonic integrated-circuit market. With the rise of cloud computing and big data analytics, data centers require high-speed and efficient communication systems. Photonic integrated circuits offer the necessary bandwidth and speed, making them essential for modern data center infrastructure. Reports indicate that the European data center market is expected to reach €10 billion by 2026, with a substantial portion of this investment directed towards photonic technologies. This trend suggests that the photonic integrated-circuit market industry will benefit from the expansion of data centers, as companies seek to enhance their operational efficiency and reduce latency.

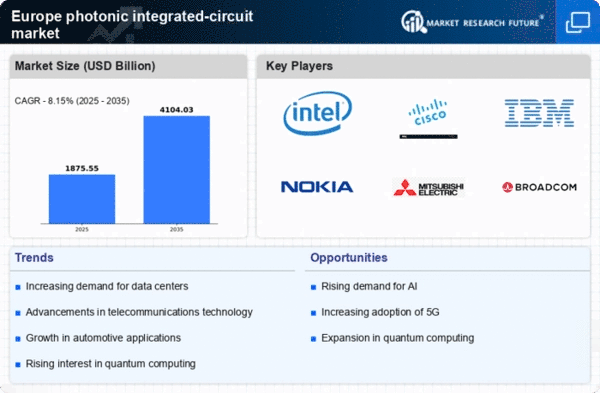

Advancements in Photonic Technologies

The photonic integrated-circuit market in Europe is experiencing a surge due to rapid advancements in photonic technologies. Innovations in materials and fabrication techniques are enhancing the performance and reducing the costs of photonic integrated circuits. For instance, the introduction of silicon photonics has enabled the integration of optical components on a single chip, leading to improved data transmission rates. This technological evolution is projected to drive the market growth, with estimates suggesting a compound annual growth rate (CAGR) of approximately 20% over the next five years. As companies invest in research and development, the photonic integrated-circuit market industry is likely to witness a proliferation of new applications across telecommunications, data centers, and consumer electronics.

Sustainability and Environmental Considerations

Sustainability is becoming a crucial factor influencing the photonic integrated-circuit market in Europe. As environmental concerns grow, there is a push for greener technologies that minimize energy consumption and reduce carbon footprints. Photonic integrated circuits are inherently more energy-efficient compared to traditional electronic circuits, making them an attractive option for companies aiming to meet sustainability goals. The European market is witnessing a shift towards eco-friendly solutions, with projections indicating that the demand for energy-efficient technologies could increase by 30% in the coming years. This trend suggests that the photonic integrated-circuit market industry will play a vital role in supporting sustainable practices across various sectors.

Increased Investment in Research and Development

Investment in research and development (R&D) within the photonic integrated-circuit market is on the rise in Europe. Governments and private entities are recognizing the strategic importance of photonics in various sectors, including telecommunications, healthcare, and automotive. Funding initiatives and collaborative projects are being established to foster innovation in photonic technologies. For example, the European Union has allocated significant resources to support photonic research, with funding exceeding €1 billion for various projects. This influx of investment is expected to accelerate advancements in the photonic integrated-circuit market industry, leading to new applications and improved performance metrics.