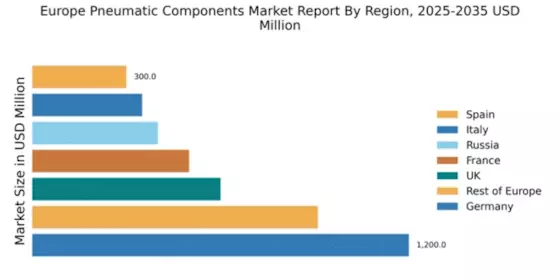

Germany : Strong Industrial Base Drives Growth

Germany holds a dominant position in the European pneumatic components market, accounting for 30% of the total market share with a value of $1200.0 million. Key growth drivers include a robust manufacturing sector, increasing automation, and a focus on Industry 4.0 initiatives. Demand trends show a rising consumption of energy-efficient pneumatic systems, supported by government policies promoting sustainable industrial practices. Infrastructure investments in transportation and logistics further bolster market growth.

UK : Innovation Fuels Competitive Landscape

The UK pneumatic components market is valued at $600.0 million, representing 15% of the European market. Growth is driven by advancements in technology and a shift towards automation in manufacturing. Demand for high-quality pneumatic systems is increasing, particularly in sectors like automotive and aerospace. Regulatory frameworks are evolving to support innovation while ensuring safety standards, which enhances market stability and growth prospects.

France : Key Player in European Market

France's pneumatic components market is valued at $500.0 million, capturing 12.5% of the European market. The growth is fueled by diverse applications across industries such as food processing, pharmaceuticals, and automotive. Demand trends indicate a shift towards smart pneumatic systems, aligning with France's commitment to innovation and sustainability. Government initiatives are focused on enhancing industrial competitiveness and reducing carbon footprints, further driving market growth.

Russia : Industrial Growth Sparks Opportunities

Russia's pneumatic components market is valued at $400.0 million, accounting for 10% of the European market. Key growth drivers include industrial modernization and increased investment in infrastructure projects. Demand is rising in sectors like oil and gas, manufacturing, and construction. Regulatory policies are gradually improving, fostering a more favorable business environment. The market is characterized by a growing interest in automation and efficiency improvements.

Italy : Innovation and Tradition Combined

Italy's pneumatic components market is valued at $350.0 million, representing 8.75% of the European market. The growth is driven by a strong manufacturing base, particularly in machinery and automotive sectors. Demand trends show a preference for customized pneumatic solutions, reflecting Italy's focus on quality and innovation. Government initiatives are aimed at supporting small and medium enterprises, enhancing competitiveness in the global market.

Spain : Focus on Automation and Efficiency

Spain's pneumatic components market is valued at $300.0 million, making up 7.5% of the European market. Growth is driven by increasing automation in manufacturing and a rising demand for energy-efficient solutions. Key sectors include automotive, food and beverage, and renewable energy. Regulatory frameworks are evolving to support innovation and sustainability, creating a conducive environment for market expansion and investment.

Rest of Europe : Varied Growth Across Sub-regions

The Rest of Europe pneumatic components market is valued at $909.96 million, accounting for 22.75% of the total market. Growth is driven by varying industrial needs across countries, with a focus on automation and efficiency. Demand trends indicate a rising interest in smart technologies and sustainable solutions. Regulatory policies differ significantly, impacting market dynamics and competitive landscapes in each country.