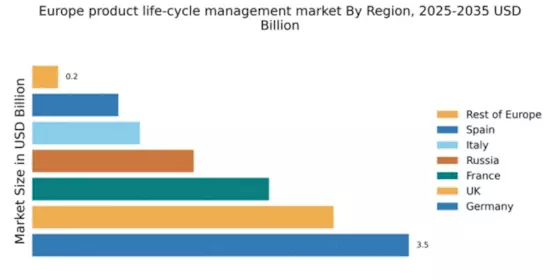

Germany : Strong industrial base drives growth

Germany holds a commanding 3.5% market share in the European product life-cycle management (PLM) sector, valued at approximately €1.5 billion. Key growth drivers include a robust manufacturing sector, increasing digitalization, and a focus on sustainability. Demand trends show a shift towards integrated solutions that enhance efficiency and reduce time-to-market. Government initiatives, such as Industry 4.0, support innovation and infrastructure development, fostering a conducive environment for PLM adoption.

UK : Innovation fuels PLM adoption

The UK accounts for 2.8% of the European PLM market, valued at around €1.2 billion. Growth is driven by advancements in technology and a strong emphasis on R&D across various sectors, including automotive and aerospace. The demand for cloud-based PLM solutions is rising, supported by government policies promoting digital innovation. The competitive landscape is characterized by a mix of local and international players, with London and Manchester being key hubs for PLM activities.

France : Sustainability and innovation lead

France holds a 2.2% share of the European PLM market, valued at approximately €950 million. The growth is propelled by a strong focus on sustainable practices and innovation in manufacturing. Demand for PLM solutions is increasing, particularly in the aerospace and automotive industries, driven by regulatory policies aimed at reducing environmental impact. Key cities like Paris and Toulouse are central to the PLM ecosystem, hosting major players like Dassault Systèmes and SAP.

Russia : Investment in technology is key

Russia represents a 1.5% share of the European PLM market, valued at around €650 million. The market is growing due to increased investments in technology and infrastructure, particularly in the energy and manufacturing sectors. Demand for PLM solutions is rising as companies seek to enhance operational efficiency. Key cities such as Moscow and St. Petersburg are pivotal, with local and international players vying for market share in a developing business environment.

Italy : Heritage meets modern technology

Italy accounts for 1.0% of the European PLM market, valued at approximately €450 million. The growth is driven by traditional industries, such as fashion and automotive, increasingly adopting PLM solutions to streamline processes. Demand trends indicate a shift towards digital transformation, supported by government initiatives promoting innovation. Key markets include Milan and Turin, where major players like Siemens and PTC are establishing a strong presence.

Spain : Focus on innovation and efficiency

Spain holds a 0.8% share of the European PLM market, valued at around €350 million. The market is expanding as companies in sectors like construction and automotive seek to improve efficiency through digital solutions. Government policies encouraging technological adoption are fostering a favorable environment for PLM growth. Key cities such as Barcelona and Madrid are emerging as important centers for PLM activities, with a mix of local and international players.

Rest of Europe : Tailored solutions for varied industries

The Rest of Europe accounts for a 0.24% share of the PLM market, valued at approximately €100 million. This sub-region encompasses a variety of markets with unique demands, driven by local industries such as textiles and food processing. Growth is supported by increasing awareness of PLM benefits and government initiatives promoting digital transformation. The competitive landscape is fragmented, with numerous small to medium enterprises playing a significant role in the market.