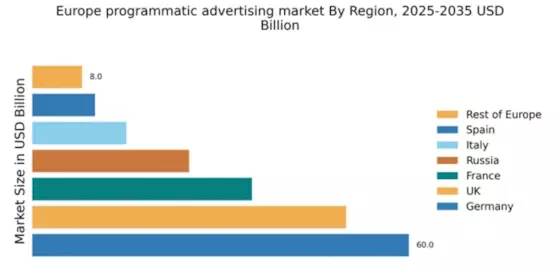

Germany : Germany's Dominance in Digital Ads

Germany holds a commanding 60.0% market share in the European programmatic advertising landscape, valued at approximately €3.6 billion. Key growth drivers include a robust digital infrastructure, increasing mobile internet penetration, and a shift towards data-driven marketing strategies. Regulatory frameworks, such as the GDPR, have shaped consumer data usage, while government initiatives support digital innovation and advertising technology development. The demand for personalized advertising continues to rise, reflecting changing consumer preferences.

UK : UK's Innovative Advertising Landscape

The UK boasts a 50.0% market share in programmatic advertising, translating to around €2.5 billion. Growth is fueled by a strong e-commerce sector, high smartphone usage, and a focus on data analytics. The UK government has implemented policies to enhance digital skills and support tech startups, fostering a conducive environment for programmatic growth. Consumer behavior is increasingly leaning towards online shopping, driving demand for targeted advertising solutions.

France : France's Growth in Programmatic Market

France captures a 35.0% share of the programmatic advertising market, valued at approximately €1.8 billion. The growth is driven by a vibrant tech ecosystem, increasing investment in digital marketing, and a rise in mobile advertising. Regulatory measures, including the CNIL's guidelines on data protection, influence market dynamics. The French government promotes digital transformation initiatives, enhancing the advertising landscape.

Russia : Russia's Diverse Advertising Landscape

Russia holds a 25.0% market share in programmatic advertising, valued at around €1.2 billion. Key growth drivers include a large online audience and increasing internet penetration. However, regulatory challenges and geopolitical factors impact market dynamics. The Russian government has initiated programs to support digital advertising, while local players like Yandex are gaining traction against international competitors.

Italy : Italy's Evolving Market Dynamics

Italy accounts for a 15.0% share of the programmatic advertising market, valued at approximately €750 million. Growth is driven by increasing digital media consumption and a shift towards online retail. Government initiatives aimed at enhancing digital literacy and infrastructure are pivotal. The competitive landscape features both local and international players, with cities like Milan emerging as key advertising hubs.

Spain : Spain's Rising Programmatic Market

Spain captures a 10.0% market share in programmatic advertising, valued at around €500 million. The market is driven by a growing digital audience and increased investment in online advertising. Regulatory frameworks are evolving to support digital marketing practices. Major cities like Madrid and Barcelona are central to the advertising ecosystem, with local firms and international players competing for market share.

Rest of Europe : Varied Landscape Across Europe

The Rest of Europe holds a 7.95% market share in programmatic advertising, valued at approximately €400 million. Growth is uneven, with some countries rapidly adopting digital advertising while others lag. Regulatory environments vary significantly, impacting market entry for international players. Local dynamics are influenced by cultural factors and economic conditions, creating unique opportunities for tailored advertising solutions.