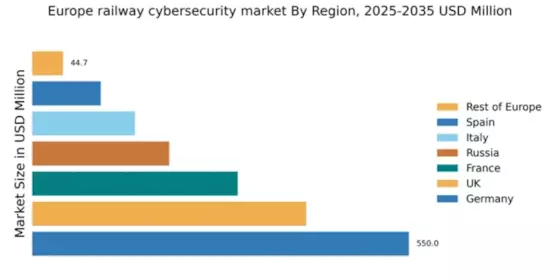

Germany : Strong Infrastructure and Innovation Drive Growth

Key cities such as Berlin, Munich, and Frankfurt are pivotal in the railway cybersecurity landscape. The competitive environment features major players like Siemens and Thales, which are actively innovating to meet the growing demand. The local market dynamics are characterized by a strong emphasis on public-private partnerships and collaboration with technology providers. The railway sector is increasingly adopting IoT and AI technologies, leading to enhanced cybersecurity applications across various rail systems.

UK : Government Initiatives Fuel Market Expansion

Key markets include London, Manchester, and Birmingham, where significant investments in railway infrastructure are underway. The competitive landscape features major players like Cisco and Alstom, which are focusing on innovative cybersecurity solutions tailored for the railway sector. The business environment is characterized by a collaborative approach among stakeholders, including government agencies and private firms, to address cybersecurity challenges effectively. The integration of smart technologies in rail systems is also driving sector-specific applications.

France : Strong Regulatory Framework Supports Growth

Key cities such as Paris, Lyon, and Marseille are central to the railway cybersecurity market. Major players like Thales and Alstom are actively involved in developing innovative cybersecurity solutions tailored for the railway industry. The competitive landscape is marked by a mix of established firms and emerging startups, fostering a dynamic business environment. The integration of advanced technologies, such as AI and machine learning, is enhancing the effectiveness of cybersecurity applications in the railway sector.

Russia : Government Focus on Cybersecurity Initiatives

Key markets include Moscow and St. Petersburg, where significant investments in railway modernization are taking place. The competitive landscape features local players like Kaspersky, which is focusing on cybersecurity solutions tailored for the railway sector. The business environment is characterized by a growing collaboration between government agencies and private firms to address cybersecurity challenges. The railway sector is increasingly adopting digital technologies, leading to enhanced cybersecurity applications.

Italy : Investment in Infrastructure Drives Demand

Key cities such as Rome, Milan, and Turin are central to the railway cybersecurity landscape. The competitive environment features major players like Bombardier and Cisco, which are actively developing innovative cybersecurity solutions. The local market dynamics are characterized by a collaborative approach among stakeholders, including government agencies and private firms, to address cybersecurity challenges effectively. The integration of smart technologies in rail systems is driving sector-specific applications.

Spain : Focus on Modernizing Rail Infrastructure

Key markets include Madrid and Barcelona, where significant investments in railway modernization are underway. The competitive landscape features major players like Siemens and Alstom, which are focusing on innovative cybersecurity solutions tailored for the railway sector. The business environment is characterized by a collaborative approach among stakeholders, including government agencies and private firms, to address cybersecurity challenges effectively. The integration of advanced technologies in rail systems is driving sector-specific applications.

Rest of Europe : Varied Regulatory Environments Impact Growth

Key markets include countries like Belgium, Netherlands, and Switzerland, where investments in railway infrastructure are on the rise. The competitive landscape features a mix of local and international players, each adapting to the unique challenges of their respective markets. The business environment is shaped by varying government policies and initiatives aimed at enhancing cybersecurity in the railway sector. The integration of digital technologies is also driving demand for sector-specific applications.