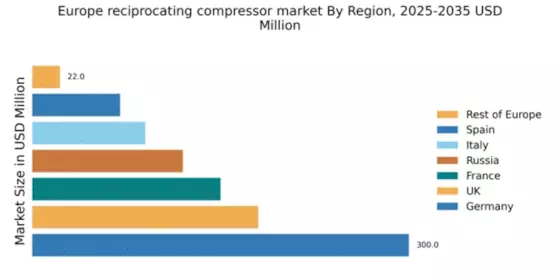

Germany : Strong industrial base drives growth

Germany holds a dominant position in the European reciprocating compressor market, accounting for 300.0 million, representing a significant market share. Key growth drivers include a robust manufacturing sector, increasing demand for energy-efficient solutions, and government initiatives promoting sustainable industrial practices. The country’s stringent regulatory policies further encourage the adoption of advanced compressor technologies, while ongoing infrastructure projects bolster demand across various industries.

UK : Diverse applications fuel demand

The UK reciprocating compressor market is valued at 180.0 million, reflecting a growing demand driven by sectors such as oil and gas, automotive, and food processing. The market is supported by government initiatives aimed at enhancing energy efficiency and reducing carbon emissions. Additionally, the ongoing transition to renewable energy sources is expected to further boost compressor demand, particularly in industrial applications.

France : Innovation and sustainability focus

France's reciprocating compressor market is valued at 150.0 million, with growth driven by increasing industrial automation and a focus on sustainable practices. The French government has implemented policies to support green technologies, which positively impacts compressor demand. Additionally, the automotive and aerospace industries are significant consumers, driving innovation in compressor technology and efficiency.

Russia : Industrial recovery boosts demand

Russia's reciprocating compressor market is valued at 120.0 million, with growth fueled by the recovery of its industrial sector. Key drivers include increased investments in oil and gas exploration and production, as well as infrastructure development projects. Government initiatives aimed at modernizing industrial facilities are also contributing to rising demand for advanced compressor solutions, particularly in remote regions.

Italy : Manufacturing sector drives growth

Italy's reciprocating compressor market is valued at 90.0 million, with significant contributions from the manufacturing and food processing sectors. The market is characterized by a strong focus on innovation and energy efficiency, supported by government incentives for sustainable technologies. Regional disparities exist, with northern regions like Lombardy and Emilia-Romagna being key industrial hubs driving compressor demand.

Spain : Energy efficiency initiatives lead growth

Spain's reciprocating compressor market is valued at 70.0 million, with growth driven by sectors such as construction, automotive, and renewable energy. Government policies promoting energy efficiency and sustainability are enhancing market dynamics. Key cities like Madrid and Barcelona are central to industrial activities, fostering a competitive landscape with both local and international players actively participating in the market.

Rest of Europe : Diverse needs across regions

The Rest of Europe reciprocating compressor market is valued at 22.0 million, characterized by diverse industrial needs across various countries. Growth is driven by localized demand in sectors such as manufacturing, healthcare, and food processing. Regulatory frameworks vary significantly, influencing market dynamics and competitive strategies. Smaller players often dominate, catering to niche applications and regional requirements.