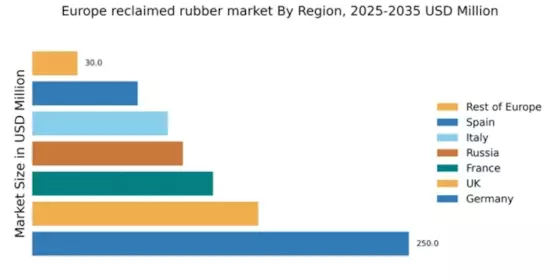

Germany : Strong Demand and Innovation Drive Growth

Key markets include major cities like Stuttgart, Munich, and Berlin, where automotive and manufacturing industries thrive. The competitive landscape features significant players such as Continental AG and Trelleborg AB, which are investing in innovative technologies. Local dynamics favor a business environment that encourages sustainability, with reclaimed rubber being utilized in tire manufacturing, construction, and consumer goods.

UK : Sustainability Initiatives Boost Market

Key markets include London, Birmingham, and Manchester, where industrial activities are concentrated. The competitive landscape features players like Goodyear Tire & Rubber Company and Michelin, which are focusing on sustainable practices. The local market is characterized by a growing emphasis on eco-friendly products, with reclaimed rubber being used in tires, flooring, and various industrial applications.

France : Innovative Solutions in Reclaimed Rubber

Key markets include Paris, Lyon, and Marseille, where industrial activities are robust. Major players like Michelin are leading the charge in innovation and sustainability. The competitive landscape is evolving, with a focus on developing high-quality reclaimed rubber products for tires and other applications. The local business environment is supportive of green initiatives, enhancing the market's growth potential.

Russia : Industrial Development Fuels Demand

Key markets include Moscow and St. Petersburg, where industrial activities are concentrated. The competitive landscape features local players and international companies like Bridgestone Corporation. The business environment is gradually improving, with a focus on sustainability and innovation. Reclaimed rubber is increasingly being used in tire manufacturing and construction materials, reflecting a shift towards greener practices.

Italy : Reclaimed Rubber in High Demand

Key markets include Milan, Turin, and Bologna, where industrial activities are concentrated. Major players like Pirelli & C. S.p.A. are investing in sustainable practices and innovative technologies. The competitive landscape is characterized by a mix of local and international companies, with reclaimed rubber being utilized in tires, flooring, and other industrial applications. The local business environment is supportive of green initiatives, fostering market growth.

Spain : Reclaimed Rubber Adoption on Rise

Key markets include Madrid and Barcelona, where industrial activities are concentrated. The competitive landscape features local players and international companies, with a focus on sustainable practices. The local market dynamics favor eco-friendly products, with reclaimed rubber being used in tires, construction materials, and consumer goods. The business environment is evolving, with increasing support for green initiatives.

Rest of Europe : Regional Variations in Demand

Key markets include various countries with emerging industries. The competitive landscape is diverse, featuring a mix of local and international players. The business environment varies significantly, with some regions facing challenges in infrastructure and regulatory support. Reclaimed rubber is being utilized in various applications, reflecting the unique market dynamics of each country.