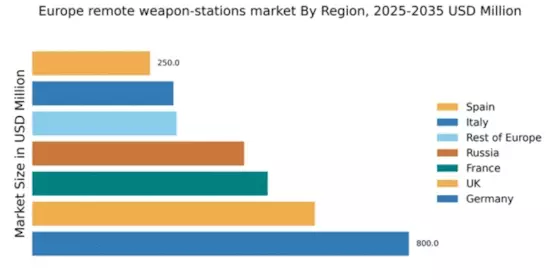

Germany : Strong Defense Investment and Innovation

Key markets include Berlin, Munich, and Hamburg, where major defense contractors like Rheinmetall and Thales Group have a significant presence. The competitive landscape is characterized by a mix of established players and emerging startups, fostering innovation. Local dynamics are influenced by government contracts and partnerships with NATO allies, driving demand in sectors such as land and naval defense applications. The business environment is conducive to growth, supported by favorable policies and investment in R&D.

UK : Strategic Alliances and Innovation

Key markets include London, Bristol, and Manchester, where major players like BAE Systems and Thales UK operate. The competitive landscape is marked by collaboration between government and industry, fostering innovation. Local market dynamics are influenced by defense procurement policies and partnerships with international allies. The business environment is favorable, with a focus on high-tech applications in land and air defense sectors.

France : Innovation and Strategic Partnerships

Key markets include Paris, Toulouse, and Lyon, where major players like Thales Group and Nexter Systems are prominent. The competitive landscape features a mix of established firms and innovative startups, driving technological advancements. Local dynamics are shaped by government contracts and collaborations with NATO allies, influencing demand in sectors such as land and naval defense. The business environment is conducive to growth, supported by favorable policies and investment in defense technology.

Russia : Defense Modernization and Innovation

Key markets include Moscow, St. Petersburg, and Kazan, where major players like Almaz-Antey and Kalashnikov Concern operate. The competitive landscape is characterized by state-owned enterprises and a focus on military innovation. Local market dynamics are influenced by government procurement policies and strategic partnerships with allied nations. The business environment is shaped by a focus on high-tech applications in land and air defense sectors, driving demand for advanced weapon systems.

Italy : Strategic Investments and Partnerships

Key markets include Rome, Milan, and Turin, where major players like Leonardo and Fincantieri are prominent. The competitive landscape features collaboration between government and industry, fostering innovation. Local dynamics are influenced by defense procurement policies and partnerships with NATO allies. The business environment is favorable, with a focus on high-tech applications in land and naval defense sectors, driving demand for advanced systems.

Spain : Investment in Defense Capabilities

Key markets include Madrid, Barcelona, and Seville, where major players like Indra and Navantia operate. The competitive landscape is characterized by collaboration between government and industry, fostering innovation. Local market dynamics are influenced by defense procurement policies and partnerships with NATO allies. The business environment is conducive to growth, supported by favorable policies and investment in defense technology.

Rest of Europe : Varied Demand Across Regions

Key markets include cities across Scandinavia, the Baltics, and Eastern Europe, where local players and international firms operate. The competitive landscape is marked by a mix of established companies and emerging startups, driving innovation. Local dynamics are influenced by government procurement policies and regional security collaborations. The business environment varies significantly, with a focus on high-tech applications in land and air defense sectors, driving demand for advanced systems.