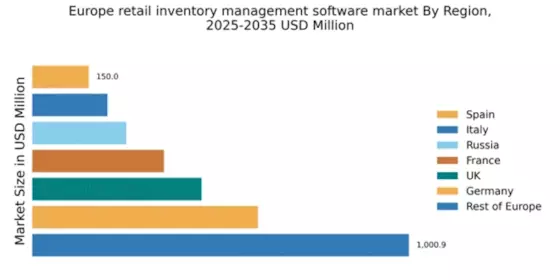

Germany : Strong Demand and Innovation Drive Growth

Key markets include major cities like Berlin, Munich, and Frankfurt, which are hubs for technology and commerce. The competitive landscape features strong players such as SAP and Oracle, alongside emerging startups. Local market dynamics are characterized by a focus on efficiency and automation, with businesses increasingly seeking integrated solutions. Industries such as retail, manufacturing, and e-commerce are primary sectors utilizing inventory management software, driving innovation and investment in this space.

UK : E-commerce Boom Fuels Demand

Key markets include London, Manchester, and Birmingham, where a concentration of retail businesses drives software adoption. The competitive landscape features major players like Microsoft and NetSuite, alongside local firms. The business environment is dynamic, with a focus on innovation and customer experience. Retail sectors, particularly fashion and electronics, are significant users of inventory management software, reflecting changing consumer behaviors and preferences.

France : Innovation and Regulation Shape Market

Key markets include Paris, Lyon, and Marseille, where retail and e-commerce sectors are thriving. The competitive landscape features significant players like SAP and Oracle, alongside local startups. The business environment is characterized by a focus on sustainability and customer-centric solutions. Industries such as food and beverage, fashion, and electronics are primary users of inventory management software, reflecting diverse consumer needs and preferences.

Russia : Digital Transformation Accelerates Growth

Key markets include Moscow and St. Petersburg, where a concentration of retail and logistics companies drives software adoption. The competitive landscape features both international players and local firms, creating a diverse market environment. The business climate is improving, with a focus on efficiency and cost-effectiveness. Sectors such as retail, manufacturing, and logistics are significant users of inventory management software, reflecting the country's economic diversification efforts.

Italy : Cultural Heritage Meets Modern Solutions

Key markets include Milan, Rome, and Florence, where retail and fashion industries are prominent. The competitive landscape features major players like SAP and local firms, fostering innovation. The business environment is characterized by a blend of tradition and modernity, with a focus on quality and craftsmanship. Sectors such as fashion, food, and luxury goods are primary users of inventory management software, reflecting Italy's unique market dynamics.

Spain : E-commerce Growth Drives Adoption

Key markets include Madrid and Barcelona, where a concentration of retail businesses drives software adoption. The competitive landscape features both international players and local startups, creating a vibrant market environment. The business climate is dynamic, with a focus on innovation and customer experience. Retail sectors, particularly fashion and electronics, are significant users of inventory management software, reflecting changing consumer behaviors and preferences.

Rest of Europe : Varied Needs Across Sub-regions

Key markets include cities across Scandinavia, Eastern Europe, and the Benelux region, where retail and logistics sectors are evolving. The competitive landscape features a mix of international and local players, fostering innovation and collaboration. The business environment is characterized by varying levels of market maturity and consumer preferences. Sectors such as retail, manufacturing, and e-commerce are significant users of inventory management software, reflecting the region's diverse economic landscape.