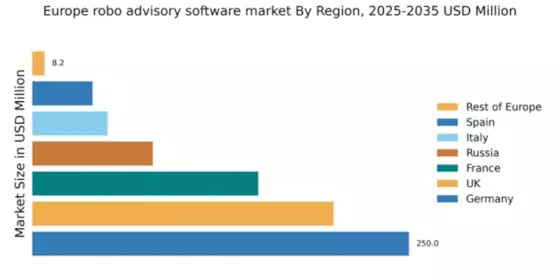

Germany : Strong Growth and Innovation Hub

Germany holds a commanding market share of 250.0 USD Million, representing approximately 35% of the European robo advisory market. Key growth drivers include a robust fintech ecosystem, increasing digital adoption, and favorable regulatory frameworks that encourage innovation. The demand for automated investment solutions is rising, driven by a younger, tech-savvy population seeking efficient wealth management options. Government initiatives supporting digital finance further bolster this growth, alongside significant infrastructure investments in technology and data security.

UK : Innovation Meets Tradition in Finance

The UK robo advisory market is valued at 200.0, accounting for about 28% of the European landscape. Growth is fueled by a blend of traditional financial institutions and innovative startups, creating a competitive environment. The demand for personalized investment solutions is on the rise, particularly among millennials and Gen Z. Regulatory support from the Financial Conduct Authority (FCA) ensures consumer protection while promoting innovation, making the UK a favorable market for robo advisory services.

France : Growth Driven by Digital Transformation

France's robo advisory market is valued at 150.0, representing roughly 21% of the European market. The growth is driven by increasing digitalization and a shift towards self-directed investment among consumers. Regulatory frameworks are evolving to support fintech innovations, while government initiatives promote financial literacy. The demand for sustainable investment options is also gaining traction, reflecting changing consumer preferences towards ESG criteria.

Russia : Robo Advisory Gaining Traction

Russia's robo advisory market is valued at 80.0, making up about 11% of the European market. Key growth drivers include a rising middle class and increasing internet penetration. Demand for automated investment solutions is growing, particularly among younger investors. However, regulatory challenges and economic volatility pose risks. The government is working on improving the investment climate, which could enhance market conditions for robo advisory services in the future.

Italy : Cultural Factors Shape Investment Trends

Italy's robo advisory market is valued at 50.0, representing about 7% of the European market. Growth is hindered by cultural preferences for traditional banking and investment methods. However, increasing awareness of digital solutions is slowly changing consumer behavior. Regulatory bodies are beginning to adapt to the fintech landscape, promoting innovation while ensuring consumer protection. The demand for tailored investment solutions is emerging, particularly among younger demographics.

Spain : Market Evolving with Consumer Needs

Spain's robo advisory market is valued at 40.0, accounting for approximately 6% of the European market. The growth is driven by increasing financial literacy and a shift towards digital investment platforms. Regulatory support from the Comisión Nacional del Mercado de Valores (CNMV) is fostering a more favorable environment for fintech innovations. The demand for low-cost investment solutions is rising, particularly among millennials seeking to build wealth efficiently.

Rest of Europe : Diverse Opportunities Across Regions

The Rest of Europe holds a market value of 8.15, representing a small fraction of the overall market. Growth potential varies significantly across countries, influenced by local regulations and consumer preferences. Some regions are embracing digital investment solutions, while others remain cautious. The competitive landscape is fragmented, with local players emerging alongside established international firms. Regulatory environments are evolving, which could enhance market opportunities in the future.