Surge in Manufacturing Automation

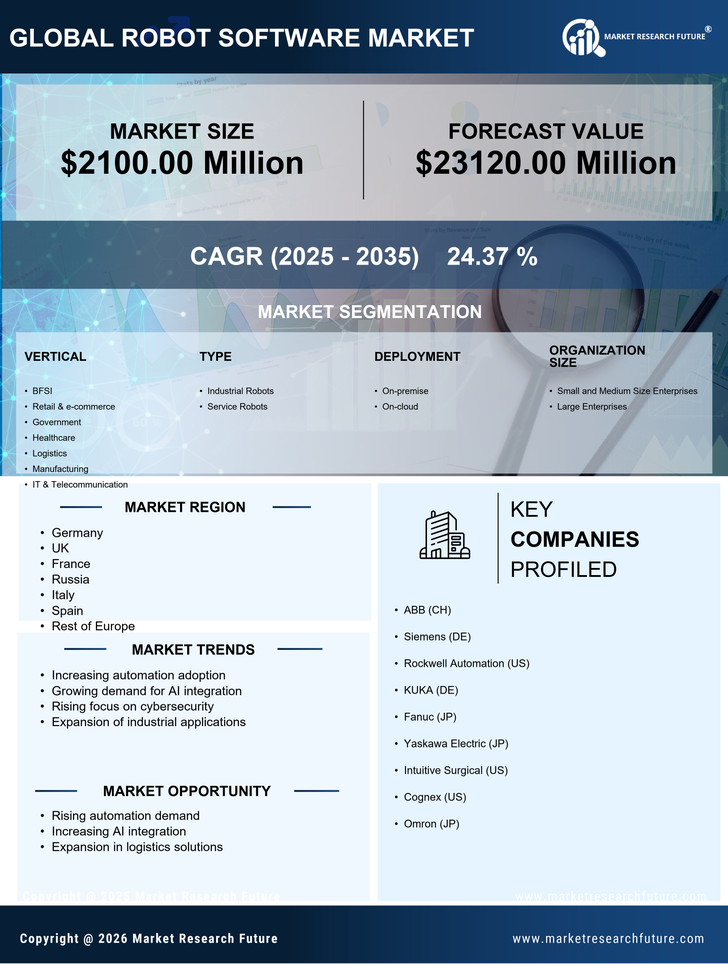

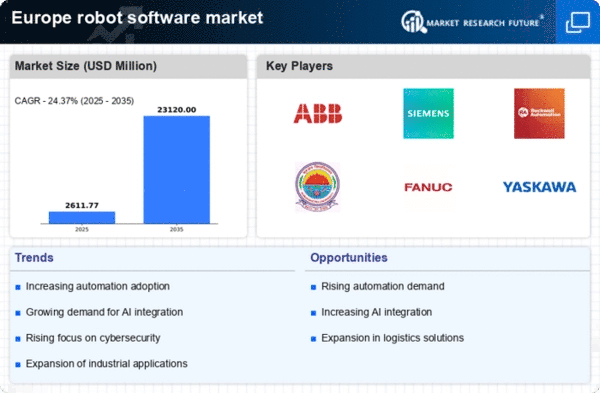

the robot software market in Europe is experiencing a notable surge in demand due to increasing automation in manufacturing processes. Industries are increasingly adopting robotic solutions to enhance productivity and reduce operational costs. According to recent data, the automation market in Europe is projected to grow at a CAGR of 10% from 2025 to 2030. This growth is driven by the need for efficiency and precision in production lines, where robot software plays a crucial role in controlling and optimizing robotic systems. As manufacturers seek to remain competitive, the integration of advanced robot software becomes essential, leading to a robust expansion of the market. The trend towards smart factories further amplifies this demand, as companies invest in technologies that enable real-time data analysis and adaptive manufacturing processes.

Rising Demand for Collaborative Robots

The increasing interest in collaborative robots, or cobots, significantly impacts the robot software market in Europe. These robots are designed to work alongside human operators, enhancing productivity while ensuring safety. The market for cobots is expected to grow by approximately 25% annually, reflecting a shift in how industries approach automation. Companies are increasingly recognizing the benefits of integrating cobots into their workflows, as they can be easily programmed and deployed in various applications. This trend necessitates the development of sophisticated robot software that can facilitate seamless human-robot interaction. As industries strive for greater flexibility and efficiency, the demand for collaborative robot solutions continues to rise, driving innovation within the robot software market.

Expansion of E-commerce and Logistics Automation

The rapid expansion of e-commerce in Europe significantly impacts the robot software market, particularly in logistics and supply chain automation. With online shopping becoming increasingly prevalent, companies are investing in automated solutions to streamline their operations and enhance delivery efficiency. The logistics sector is projected to grow by 20% over the next five years, driven by the need for faster and more reliable order fulfillment. This growth necessitates the implementation of advanced robot software that can manage inventory, optimize routing, and facilitate automated picking and packing processes. As e-commerce continues to thrive, the demand for sophisticated robotic solutions in logistics is likely to propel the robot software market forward, creating new avenues for innovation and growth.

Advancements in Robotics Research and Development

Ongoing advancements in robotics research and development are pivotal for the growth of the robot software market in Europe. Research institutions and private companies are investing heavily in developing cutting-edge technologies that enhance the capabilities of robotic systems. This investment is reflected in the increasing number of patents filed in the robotics sector, which has seen a rise of over 15% in recent years. Innovations in artificial intelligence, machine learning, and sensor technologies are enabling robots to perform more complex tasks with higher accuracy. Consequently, the demand for advanced robot software that can leverage these technologies is on the rise. As the landscape of robotics evolves, the robot software market is likely to benefit from these advancements, leading to more sophisticated and capable robotic solutions.

Growing Focus on Sustainability and Green Technologies

the robot software market in Europe is influenced by a growing focus on sustainability and green technologies. As industries strive to reduce their carbon footprint, there is a rising demand for robotic solutions that promote energy efficiency and resource conservation. The European Union has set ambitious targets for reducing greenhouse gas emissions, which encourages companies to adopt sustainable practices. This shift is likely to drive the development of robot software that optimizes energy consumption and minimizes waste during manufacturing processes. Furthermore, the integration of eco-friendly technologies in robotics is expected to create new opportunities within the market, as businesses seek to align with environmental regulations and consumer preferences for sustainable products.