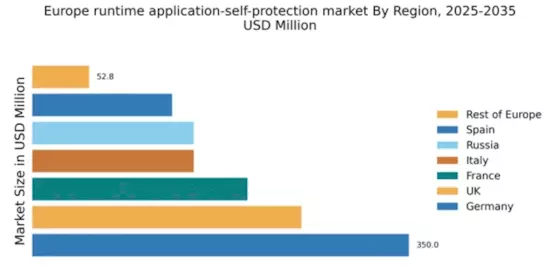

Germany : Strong Demand and Innovation Drive Growth

Key cities such as Berlin, Munich, and Frankfurt are pivotal in the market landscape, hosting numerous tech startups and established firms. The competitive environment features major players like IBM, Microsoft, and Fortinet, all vying for market share. Local dynamics are characterized by a strong emphasis on compliance and security, with businesses increasingly adopting integrated security solutions. The finance and automotive sectors are particularly active, driving demand for tailored cybersecurity applications.

UK : Innovation and Regulation Fuel Demand

London, as a financial hub, is a key market, alongside tech centers in Manchester and Cambridge. The competitive landscape includes major players like Oracle and Symantec, which have established a strong presence. The local business environment is dynamic, with a growing number of startups focusing on cybersecurity solutions. The finance and healthcare sectors are leading adopters of runtime application self-protection technologies, reflecting the urgent need for enhanced security measures.

France : Strong Demand from Diverse Sectors

Paris, Lyon, and Toulouse are significant markets, with a concentration of tech firms and startups. The competitive landscape features major players like Check Point and Palo Alto Networks, which are actively expanding their offerings. The local market dynamics are characterized by a collaborative approach between public and private sectors, fostering innovation. Key sectors such as aerospace, finance, and healthcare are increasingly adopting runtime application self-protection solutions to safeguard sensitive data.

Russia : Focus on National Security Initiatives

Moscow and St. Petersburg are key markets, hosting numerous technology firms and government agencies. The competitive landscape includes local players and international firms, with a focus on compliance with national regulations. The business environment is evolving, with an increasing emphasis on cybersecurity as a strategic priority. The finance and telecommunications sectors are leading adopters of runtime application self-protection technologies, reflecting the urgent need for enhanced security measures.

Italy : Investment in Digital Transformation

Key cities such as Milan, Rome, and Turin are central to the market, with a concentration of technology firms and startups. The competitive landscape features major players like IBM and Fortinet, which are expanding their presence in the region. The local market dynamics are characterized by a growing emphasis on compliance and security, with businesses increasingly adopting integrated security solutions. The finance and manufacturing sectors are particularly active, driving demand for tailored cybersecurity applications.

Spain : Strong Growth in Digital Security

Madrid and Barcelona are key markets, hosting numerous technology firms and startups. The competitive landscape includes major players like Trend Micro and Palo Alto Networks, which are actively expanding their offerings. The local market dynamics are characterized by a collaborative approach between public and private sectors, fostering innovation. Key sectors such as finance, healthcare, and telecommunications are increasingly adopting runtime application self-protection solutions to safeguard sensitive data.

Rest of Europe : Varied Demand Across Sub-regions

Key markets include countries like Belgium, Netherlands, and Switzerland, each with unique market characteristics. The competitive landscape features a mix of local and international players, with varying degrees of market penetration. Local dynamics are influenced by national regulations and industry-specific needs. Sectors such as finance, healthcare, and manufacturing are gradually adopting runtime application self-protection technologies, reflecting the growing recognition of cybersecurity's importance.