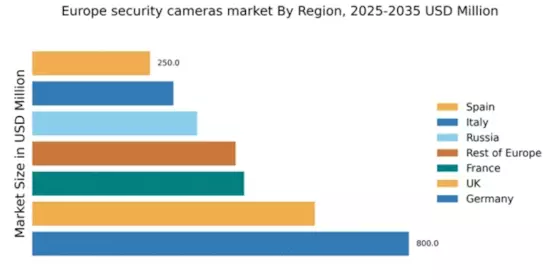

Germany : Strong Demand and Innovation Drive Growth

Key markets within Germany include major cities like Berlin, Munich, and Frankfurt, where demand for advanced security solutions is particularly high. The competitive landscape features significant players such as Bosch Security Systems and Axis Communications, which are known for their innovative products. Local market dynamics are characterized by a strong emphasis on quality and reliability, with applications spanning residential, commercial, and public sectors. The business environment is favorable, supported by a skilled workforce and technological advancements.

UK : Rising Crime Rates Fuel Demand

Key markets in the UK include London, Manchester, and Birmingham, where urbanization and crime rates are particularly high. The competitive landscape features major players like Hikvision and Honeywell, which offer a range of products tailored to local needs. The business environment is dynamic, with a growing emphasis on cybersecurity and data protection regulations. Applications span residential, commercial, and public sectors, with increasing interest in AI-driven surveillance solutions.

France : Focus on Innovation and Compliance

Key markets include Paris, Lyon, and Marseille, where demand for advanced security solutions is on the rise. The competitive landscape features players like Dahua Technology and Axis Communications, known for their innovative offerings. Local market dynamics are shaped by a focus on quality and compliance with regulations. Applications are diverse, spanning residential, commercial, and public sectors, with a growing interest in smart city initiatives.

Russia : Government Initiatives Drive Adoption

Key markets include Moscow and St. Petersburg, where urbanization and security concerns are prominent. The competitive landscape features local and international players, including Hikvision and FLIR Systems. The business environment is improving, with a focus on technological advancements and local manufacturing. Applications span various sectors, including transportation, retail, and public safety, reflecting the diverse needs of the market.

Italy : Focus on Quality and Reliability

Key markets include Rome, Milan, and Naples, where demand for security solutions is particularly strong. The competitive landscape features major players like Bosch Security Systems and Hanwha Techwin, known for their innovative technologies. Local market dynamics emphasize quality and compliance with regulations, creating a favorable business environment. Applications are diverse, spanning residential, commercial, and public sectors, with a growing interest in integrated security systems.

Spain : Urbanization Drives Market Expansion

Key markets include Madrid, Barcelona, and Valencia, where urbanization and security concerns are particularly pronounced. The competitive landscape features players like Sony and Panasonic, which offer a range of advanced security solutions. Local market dynamics are characterized by a focus on innovation and compliance with regulations. Applications span residential, commercial, and public sectors, reflecting the diverse needs of the market.

Rest of Europe : Varied Demand Across Regions

Key markets include countries like the Netherlands, Belgium, and the Nordic countries, where demand for security solutions is growing. The competitive landscape features a mix of local and international players, including Vivotek and Axis Communications. Local market dynamics are shaped by regulatory frameworks and consumer preferences, creating a unique business environment. Applications are diverse, spanning residential, commercial, and public sectors, with a focus on tailored solutions.