Regulatory Compliance Pressures

Regulatory compliance pressures are significantly influencing the security orchestration market in Europe. With stringent regulations such as the General Data Protection Regulation (GDPR) and the Network and Information Systems (NIS) Directive, organizations are compelled to implement comprehensive security measures. Non-compliance can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, whichever is higher. Consequently, businesses are increasingly turning to security orchestration solutions to ensure adherence to these regulations. These solutions facilitate the automation of compliance reporting and enhance visibility into security operations, thereby reducing the risk of non-compliance. As regulatory frameworks continue to evolve, the demand for effective security orchestration tools is likely to grow, positioning them as essential assets for organizations striving to meet compliance requirements.

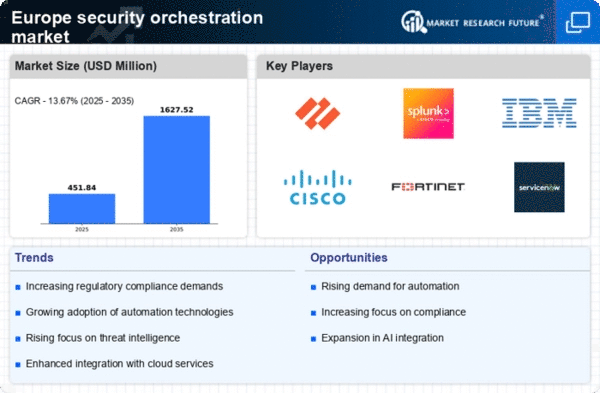

Adoption of Advanced Technologies

The adoption of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is driving the security orchestration market in Europe. Organizations are increasingly recognizing the potential of these technologies to enhance their security posture. In 2025, it is projected that the AI-driven security market will reach €30 billion, indicating a robust growth trajectory. Security orchestration solutions that leverage AI and ML can analyze vast amounts of data, identify patterns, and automate responses to threats. This capability not only improves incident response times but also reduces the burden on security teams. As businesses seek to optimize their security operations and stay ahead of emerging threats, the integration of advanced technologies into security orchestration frameworks is becoming a strategic imperative.

Increasing Cyber Threat Landscape

The escalating cyber threat landscape in Europe is a primary driver for the security orchestration market. As organizations face a growing number of sophisticated cyber attacks, the need for robust security measures becomes paramount. In 2025, it is estimated that cybercrime will cost European businesses over €200 billion annually. This alarming trend compels organizations to adopt security orchestration solutions that enhance their incident response capabilities and streamline security operations. By integrating various security tools and automating processes, businesses can effectively mitigate risks and respond to threats in real-time. The urgency to protect sensitive data and maintain operational integrity drives investment in security orchestration technologies. This makes it a critical component of modern cybersecurity strategies.

Growing Demand for Operational Efficiency

The growing demand for operational efficiency is a significant driver of the security orchestration market in Europe. Organizations are under constant pressure to optimize their security operations while managing costs effectively. Security orchestration solutions enable businesses to automate repetitive tasks, streamline workflows, and enhance collaboration among security teams. By reducing manual intervention, organizations can improve response times and minimize the risk of human error. In 2025, it is anticipated that companies will allocate approximately 25% of their IT budgets to security solutions, with a substantial portion directed towards orchestration technologies. This trend reflects a broader recognition of the need for efficient security operations that can adapt to the evolving threat landscape while maintaining cost-effectiveness.

Rise of Remote Work and Digital Transformation

The rise of remote work and ongoing digital transformation initiatives are reshaping the security orchestration market in Europe. As organizations increasingly adopt remote work models, the attack surface expands, necessitating enhanced security measures. Security orchestration solutions play a crucial role in managing the complexities associated with remote access and cloud-based services. In 2025, it is estimated that over 70% of European companies will have adopted hybrid work models, further emphasizing the need for robust security frameworks. These solutions facilitate real-time monitoring, incident response, and threat intelligence sharing, enabling organizations to safeguard their digital assets effectively. As businesses navigate the challenges of remote work and digital transformation, the demand for security orchestration technologies is likely to surge.