Advancements in Virtual Reality

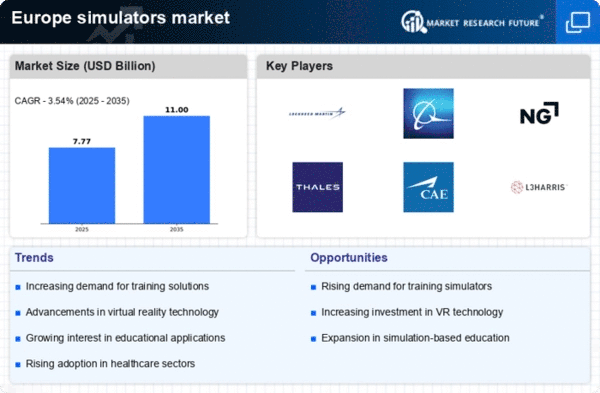

The rapid advancements in virtual reality (VR) technology are reshaping the simulators market in Europe. Enhanced graphics, improved motion tracking, and more immersive experiences are driving demand across various sectors, including education, healthcare, and military training. The European VR market is projected to grow at a CAGR of approximately 30% from 2025 to 2030, indicating a robust interest in simulation technologies. As organizations seek to provide realistic training environments, the simulators market is likely to benefit from these technological innovations. Furthermore, the integration of VR with artificial intelligence (AI) is expected to enhance the adaptability and effectiveness of training programs, making them more appealing to end-users. This trend suggests a significant shift towards more engaging and effective training solutions, positioning the simulators market as a key player in the evolving landscape of technology-driven education and training.

Expansion of E-Learning Platforms

The expansion of e-learning platforms is a notable driver for the simulators market in Europe. As educational institutions and corporate training programs increasingly adopt online learning solutions, the demand for interactive and engaging simulation tools is on the rise. E-learning platforms are integrating simulation technologies to enhance the learning experience, providing learners with opportunities to practice skills in a virtual environment. The European e-learning market is projected to grow at a CAGR of around 25% from 2025 to 2030, indicating a robust shift towards digital learning solutions. This trend suggests that the simulators market will benefit from the growing need for effective online training tools. Furthermore, the ability to access simulations remotely aligns with the increasing demand for flexible learning options, making simulation technologies a vital component of the evolving educational landscape.

Growing Demand for Safety and Risk Management

The increasing emphasis on safety and risk management across various sectors is significantly influencing the simulators market in Europe. Industries such as aviation, healthcare, and manufacturing are prioritizing safety training to mitigate risks and enhance operational safety. The European Union has implemented stringent regulations that mandate regular training and assessment for professionals in high-risk environments. This regulatory landscape is likely to drive the adoption of simulation technologies, as they provide a safe and controlled environment for training. The simulators market is expected to see a surge in demand as organizations seek to comply with these regulations while ensuring the safety of their personnel. Furthermore, the ability to simulate emergency scenarios allows for better preparedness, which is increasingly recognized as a critical component of effective risk management strategies.

Increased Investment in Training and Development

Organizations across Europe are increasingly recognizing the value of investing in training and development, which is a crucial driver for the simulators market. Companies are allocating larger budgets to enhance employee skills and competencies, particularly in high-stakes industries such as aviation, healthcare, and defense. According to recent data, corporate training expenditures in Europe are expected to reach €50 billion by 2026, reflecting a growing commitment to workforce development. This trend is likely to spur demand for advanced simulation technologies that provide realistic and effective training experiences. As businesses strive to improve operational efficiency and safety, the simulators market stands to gain from this heightened focus on employee training. The emphasis on continuous learning and skill enhancement may further drive innovation within the industry, leading to the development of more sophisticated simulation solutions.

Integration of Artificial Intelligence in Simulations

The integration of artificial intelligence (AI) into simulation technologies is emerging as a transformative driver for the simulators market in Europe. AI enhances the realism and adaptability of simulations, allowing for personalized training experiences that cater to individual learning styles. This technological advancement is particularly relevant in sectors such as healthcare, where AI-driven simulations can replicate complex medical scenarios for training purposes. The European AI market is projected to grow significantly, with investments in AI technologies expected to exceed €20 billion by 2027. This growth is likely to bolster the simulators market, as organizations seek to leverage AI to improve training outcomes and operational efficiency. The potential for AI to analyze performance data and provide real-time feedback further enhances the value of simulation technologies, making them indispensable tools for modern training and development.