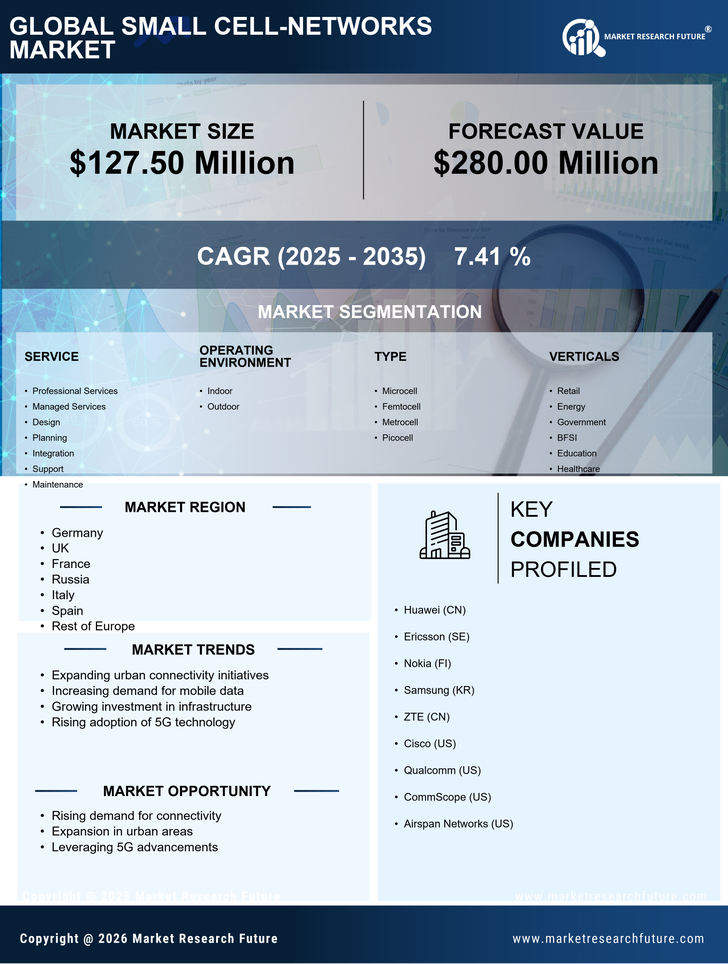

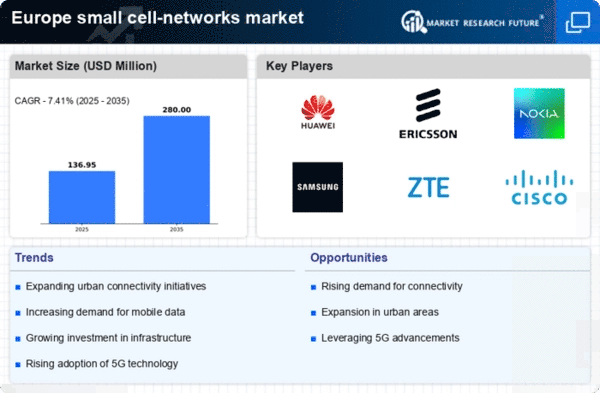

Emergence of 5G Technology

The rollout of 5G technology is a transformative factor for the small cell-networks market. As European countries continue to implement 5G networks, the need for small cells becomes increasingly apparent. Small cells are essential for achieving the high data rates and low latency that 5G promises. They enable operators to densify their networks, ensuring that users can access the full benefits of 5G technology. The European Commission has set ambitious targets for 5G deployment, aiming for widespread coverage by 2025. This regulatory push is likely to drive investments in small cell infrastructure, as operators seek to enhance their networks to meet the demands of next-generation mobile services.

Increased Mobile Data Traffic

The exponential growth in mobile data traffic is significantly influencing the small cell-networks market. With the proliferation of smartphones and IoT devices, mobile data consumption in Europe is projected to increase by over 50% by 2026. This surge necessitates the deployment of small cell networks to alleviate congestion on macro networks and ensure seamless connectivity. Small cells are particularly effective in urban environments where high user density can lead to network strain. By deploying small cells, operators can enhance capacity and improve user experience, which is crucial for maintaining competitive advantage in the telecommunications sector. As mobile data traffic continues to rise, the small cell-networks market is expected to expand in response to these demands.

Support for Smart City Initiatives

The push towards smart city initiatives is driving growth in the small cell-networks market. European cities are increasingly investing in smart technologies to improve urban living, enhance public services, and promote sustainability. Small cell networks play a vital role in supporting these initiatives by providing the necessary infrastructure for IoT devices, smart traffic management, and public safety systems. As cities aim to become more connected and efficient, the demand for small cell solutions is likely to increase. Reports indicate that investments in smart city projects in Europe could exceed €100 billion by 2025, highlighting the potential for small cell networks to facilitate these advancements and improve urban infrastructure.

Rising Focus on Network Reliability

The growing emphasis on network reliability is a crucial driver in the small cell-networks market. As businesses and consumers increasingly depend on uninterrupted connectivity, the need for resilient network solutions has become paramount. Small cell networks offer enhanced reliability by providing localized coverage and reducing the risk of outages. In Europe, where digital services are integral to economic activity, ensuring network reliability is essential for maintaining productivity. The deployment of small cells can mitigate the impact of network failures and improve overall service quality. As organizations prioritize reliable connectivity, the small cell-networks market is expected to benefit from this heightened focus on network performance.

Growing Demand for High-Speed Internet

The increasing demand for high-speed internet access is a primary driver in the small cell-networks market. As more consumers and businesses rely on digital services, the need for robust connectivity has surged. In Europe, the number of broadband subscriptions reached approximately 200 million in 2025, indicating a strong market for enhanced network solutions. Small cell networks provide the necessary infrastructure to support this demand, particularly in densely populated urban areas. The ability to deliver high-speed internet through small cells allows service providers to meet customer expectations while optimizing their existing networks. This trend is likely to continue as the reliance on cloud services and streaming platforms grows, further solidifying the role of small cell networks in enhancing connectivity across Europe.