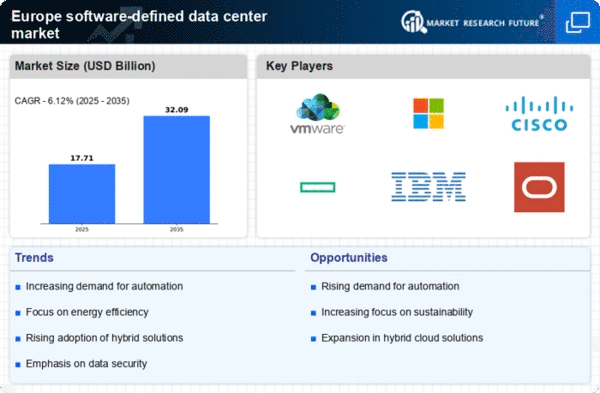

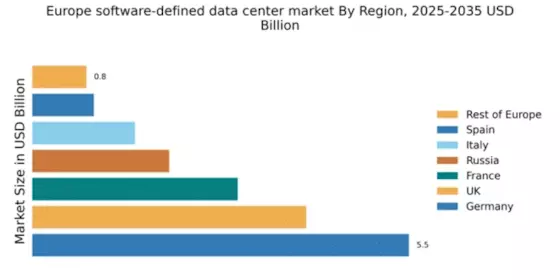

Germany : Strong Growth and Innovation Hub

Germany holds a commanding 5.5% market share in the software-defined data center (SDDC) sector, valued at approximately €2.5 billion. Key growth drivers include robust demand for cloud services, digital transformation initiatives, and government support for tech innovation. Regulatory frameworks favor data protection and privacy, enhancing consumer trust. Infrastructure investments, particularly in cities like Frankfurt and Berlin, bolster industrial development and connectivity.

UK : Innovation and Investment Surge

The UK commands a 4.0% market share in the SDDC market, valued at around €1.8 billion. Growth is driven by increasing cloud adoption, the rise of remote work, and significant investments in technology. The UK government promotes digital innovation through various initiatives, including the Digital Strategy 2025. The demand for scalable solutions is evident in urban centers like London and Manchester, where tech startups thrive.

France : Government Support Fuels Expansion

France's SDDC market holds a 3.0% share, valued at approximately €1.4 billion. Key growth drivers include government initiatives like the France 2030 plan, which aims to boost digital infrastructure. The demand for hybrid cloud solutions is rising, particularly in sectors like finance and healthcare. Cities such as Paris and Lyon are pivotal in driving technological advancements and attracting investments.

Russia : Growth Amidst Challenges

Russia's SDDC market accounts for 2.0%, valued at around €900 million. Growth is propelled by increasing digitalization across industries and government initiatives aimed at enhancing IT infrastructure. However, regulatory challenges and geopolitical factors pose risks. Key markets include Moscow and St. Petersburg, where major players like IBM and Cisco are establishing a presence to cater to local demand.

Italy : Focus on Digital Transformation

Italy's SDDC market represents 1.5% with a value of approximately €700 million. Growth is driven by the push for digital transformation across sectors, supported by government initiatives like the National Recovery and Resilience Plan. Key cities such as Milan and Rome are central to this growth, with a competitive landscape featuring players like Dell Technologies and Oracle, focusing on sectors like manufacturing and finance.

Spain : Investment in Digital Infrastructure

Spain holds a 0.9% market share in the SDDC sector, valued at around €400 million. The growth is fueled by increasing cloud adoption and government support for digital initiatives. Cities like Madrid and Barcelona are key markets, with a growing number of tech startups and established players like VMware and Microsoft. The local business environment is becoming increasingly favorable for tech investments.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe accounts for a 0.79% market share in the SDDC sector, valued at approximately €350 million. Growth drivers vary by country, influenced by local regulations and market maturity. Countries like the Netherlands and Belgium are seeing increased demand for cloud solutions. The competitive landscape includes both local and international players, adapting to diverse sector-specific needs across industries.