Increasing Health Consciousness

The growing awareness of health and wellness among consumers is a pivotal driver in the sports nutrition market. Individuals are increasingly prioritizing their physical fitness and dietary choices, leading to a surge in demand for nutritional supplements and functional foods. In Europe, a notable 60% of consumers actively seek products that enhance their athletic performance and overall health. This trend is further supported by the rise of fitness influencers and social media, which promote healthy lifestyles. As a result, brands are innovating to offer products that cater to this health-conscious demographic, including protein powders, energy bars, and hydration solutions. The sports nutrition market is thus witnessing a transformation, with companies focusing on transparency in ingredient sourcing and nutritional benefits to attract discerning consumers.

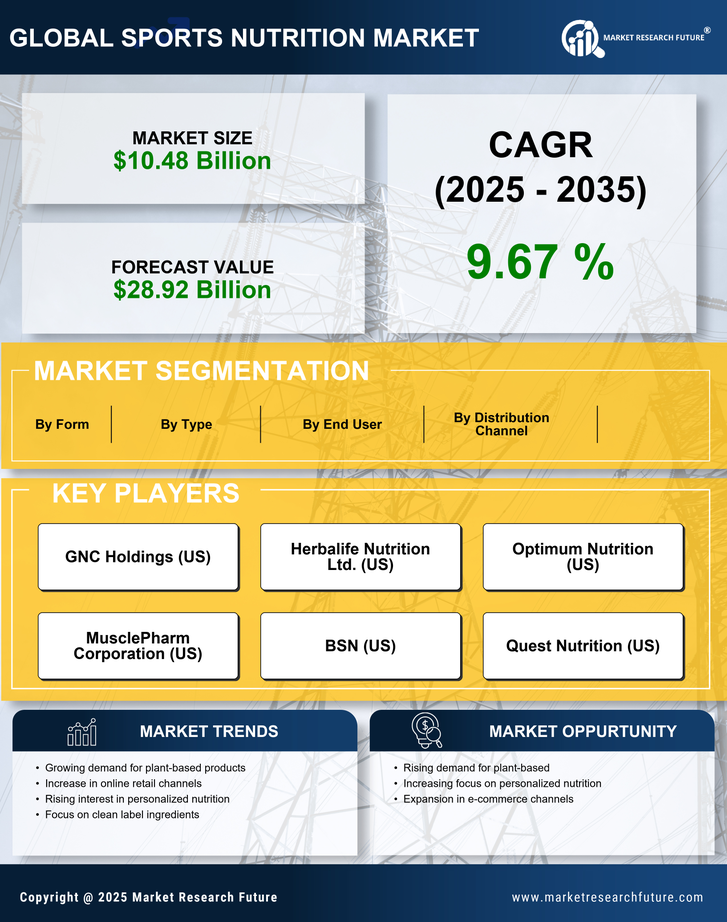

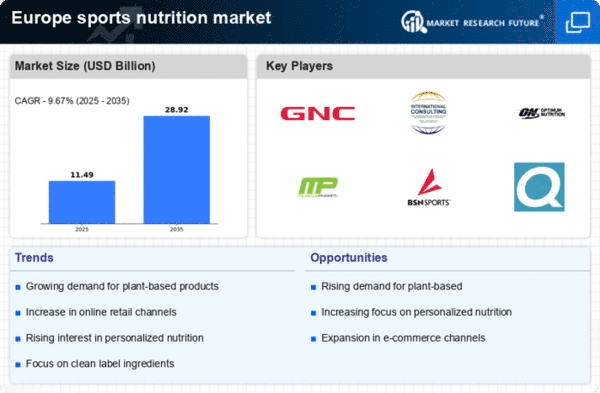

Rise of E-commerce and Online Retailing

The expansion of e-commerce and online retailing is a crucial driver for the sports nutrition market, particularly in Europe. With the convenience of online shopping, consumers are increasingly turning to digital platforms to purchase sports nutrition products. This shift is evidenced by a 30% increase in online sales of nutritional supplements over the past year. E-commerce allows for a broader reach, enabling brands to connect with consumers who may not have access to physical retail locations. Furthermore, online platforms often provide detailed product information, customer reviews, and competitive pricing, enhancing the overall shopping experience. As a result, traditional brick-and-mortar stores are adapting by integrating online strategies to remain competitive. The sports nutrition market is thus evolving, with a significant portion of sales now occurring through online channels.

Growing Popularity of Fitness Activities

The increasing participation in fitness activities is a notable driver in the sports nutrition market. As more individuals engage in sports and exercise, the demand for nutritional products that support performance and recovery is on the rise. In Europe, approximately 40% of the population participates in regular physical activity, which correlates with a heightened interest in sports nutrition. This trend is particularly evident among younger demographics, who are more inclined to invest in supplements that enhance their athletic capabilities. Brands are responding by developing targeted products, such as pre-workout formulas and recovery drinks, tailored to the needs of active individuals. The sports nutrition market is thus benefiting from this cultural shift towards fitness, with an expanding consumer base seeking effective nutritional solutions.

Influence of Social Media and Fitness Trends

The impact of social media and emerging fitness trends is a significant driver in the sports nutrition market. Platforms such as Instagram and TikTok have become influential in shaping consumer preferences and behaviors regarding nutrition and fitness. Fitness influencers often promote specific products, leading to increased visibility and sales for brands. In Europe, the engagement of consumers with fitness-related content on social media has surged, with a 50% increase in discussions around sports nutrition products. This trend encourages brands to leverage social media marketing strategies to reach potential customers effectively. Additionally, the rise of fitness challenges and community events fosters a culture of health and wellness, further driving demand for sports nutrition products. The sports nutrition market is thus adapting to this dynamic landscape, focusing on digital engagement to capture the attention of health-conscious consumers.

Technological Advancements in Product Development

Technological innovations are significantly shaping the sports nutrition market, enabling the development of advanced formulations and delivery systems. The integration of technology in product development allows for enhanced bioavailability and efficacy of nutritional supplements. For instance, the use of nanotechnology in protein supplements can improve absorption rates, making products more effective for consumers. Additionally, the rise of e-commerce platforms has facilitated access to a wider range of products, allowing consumers to explore and purchase innovative sports nutrition solutions. In Europe, the market for sports nutrition products is projected to grow at a CAGR of 8% from 2025 to 2030, driven by these technological advancements. Companies are increasingly investing in research and development to create cutting-edge products that meet the evolving needs of athletes and fitness enthusiasts.