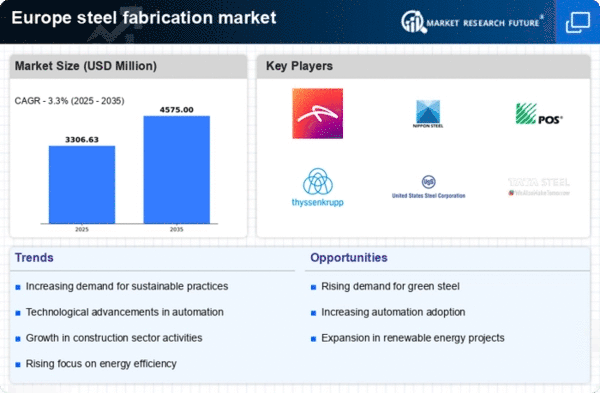

Energy Sector Expansion

The expansion of the energy sector, particularly renewable energy initiatives, is significantly influencing the steel fabrication market. Europe is increasingly focusing on transitioning to renewable energy sources, such as wind and solar power. The construction of wind farms and solar parks requires extensive steel fabrication for towers, frames, and support structures. Reports indicate that investments in renewable energy in Europe could reach €1 trillion by 2030, creating substantial opportunities for steel fabricators. Additionally, the need for energy-efficient buildings and infrastructure is likely to drive demand for fabricated steel products that meet stringent energy standards. This trend suggests a robust growth trajectory for the steel fabrication market in the energy sector.

Automotive Industry Growth

The automotive industry in Europe is experiencing a notable resurgence. This resurgence is likely to positively impact the steel fabrication market. As manufacturers shift towards electric vehicles (EVs), the demand for lightweight and high-strength steel components is increasing. The European automotive sector is projected to grow by approximately 5% annually, with a significant portion of this growth attributed to EV production. This shift necessitates advanced steel fabrication techniques to produce components that meet the specific requirements of EVs, such as battery enclosures and chassis. Consequently, the steel fabrication market is expected to benefit from this automotive evolution, as fabricators adapt to the changing needs of the industry.

Infrastructure Development

The ongoing infrastructure development across Europe is a primary driver for the steel fabrication market. Governments are investing heavily in transportation networks, including roads, bridges, and railways, which necessitate substantial steel fabrication. For instance, the European Commission has allocated approximately €1 trillion for infrastructure projects over the next decade. This investment is likely to stimulate demand for fabricated steel components, as they are essential for constructing durable and resilient structures. Furthermore, the push for modernizing existing infrastructure to meet safety and environmental standards may further enhance the market's growth. As urbanization continues, the need for efficient and sustainable infrastructure solutions will likely drive the steel fabrication market in Europe.

Construction Sector Resilience

The resilience of the construction sector in Europe drives the steel fabrication market. Despite various economic challenges, the construction industry has shown remarkable stability, with a projected growth rate of around 3% annually. This growth is fueled by residential and commercial construction projects, which require a diverse range of fabricated steel products. The increasing focus on sustainable building practices and the use of innovative materials further enhance the demand for steel fabrication. Additionally, the trend towards modular construction, which often relies on prefabricated steel components, is likely to create new opportunities for fabricators. As the construction sector continues to thrive, the steel fabrication market is poised for sustained growth.

Regulatory Compliance and Standards

Regulatory compliance and evolving standards in Europe are driving the steel fabrication market. The European Union has implemented stringent regulations regarding safety, quality, and environmental impact, which necessitate that steel fabricators adhere to specific guidelines. Compliance with these regulations often requires investment in advanced technologies and processes, which can enhance efficiency and product quality. Moreover, the increasing emphasis on sustainability and reducing carbon footprints is pushing fabricators to adopt greener practices. This shift may lead to a competitive advantage for those who can meet or exceed regulatory standards. As such, the need for compliance is likely to propel the growth of the steel fabrication market in Europe.