Focus on Environmental Sustainability

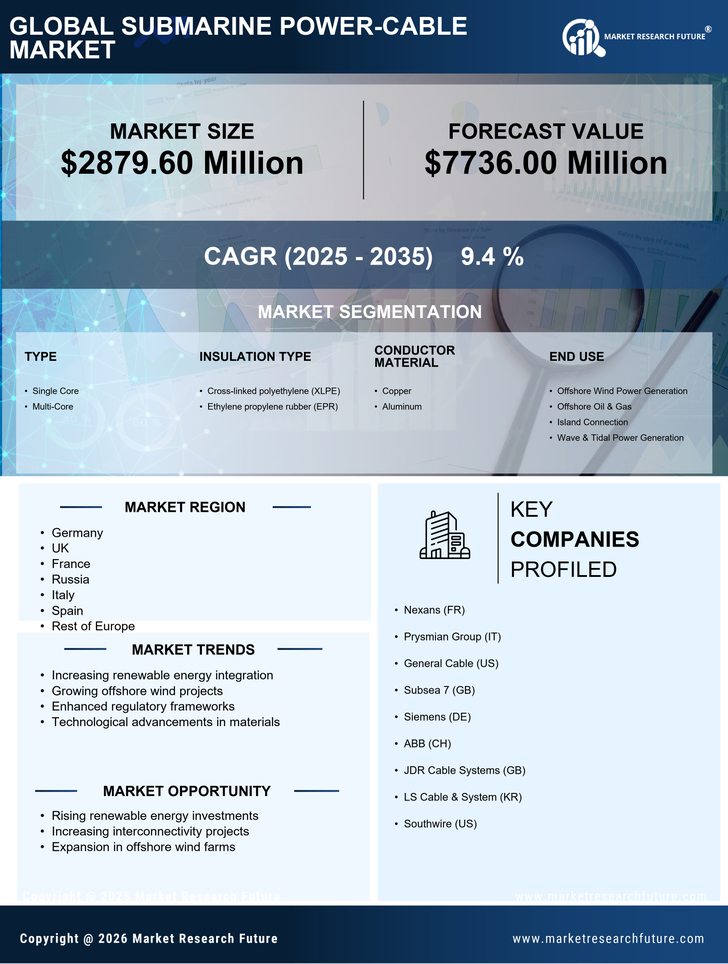

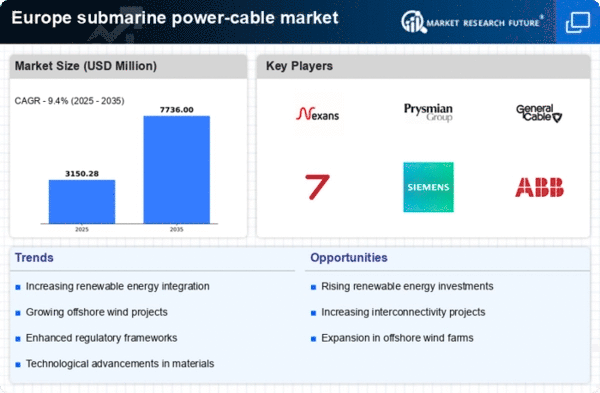

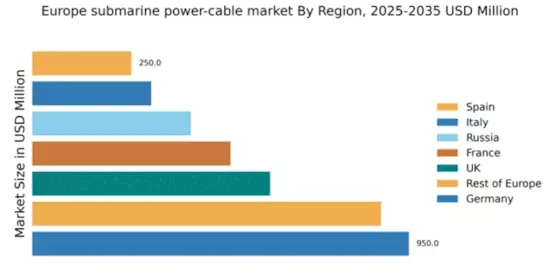

The submarine power-cable market in Europe is increasingly shaped by a focus on environmental sustainability. As climate change concerns escalate, there is a growing emphasis on reducing carbon footprints and promoting eco-friendly energy solutions. The European Green Deal aims to make Europe the first climate-neutral continent by 2050, which necessitates a transition to renewable energy sources. Submarine cables play a crucial role in this transition by facilitating the integration of renewable energy into the grid. The market is expected to see a compound annual growth rate (CAGR) of 8% over the next five years, driven by this sustainability focus. Furthermore, the development of cables with lower environmental impact is becoming a priority, indicating that sustainability is not just a trend but a fundamental driver of the submarine power-cable market.

Increasing Investment in Offshore Wind Farms

The submarine power-cable market in Europe is experiencing a surge in investment, particularly driven by the expansion of offshore wind farms. As countries aim to meet renewable energy targets, the deployment of offshore wind projects is projected to increase significantly. For instance, the European Union has set ambitious goals to generate 300 GW of offshore wind energy by 2050. This growth necessitates robust submarine power cables to connect wind farms to the grid, thereby enhancing the market's potential. The investment in this sector is expected to reach approximately €200 billion by 2030, indicating a strong commitment to renewable energy infrastructure. Consequently, the increasing investment in offshore wind farms is a pivotal driver for the submarine power-cable market, as it directly correlates with the demand for advanced cable solutions.

Technological Innovations in Cable Manufacturing

The submarine power-cable market in Europe is benefiting from technological innovations in cable manufacturing. Advances in materials and production techniques are leading to the development of more efficient and durable cables. Innovations such as the use of high-voltage direct current (HVDC) technology are enabling longer transmission distances with reduced energy losses. This is particularly relevant for connecting offshore wind farms to the mainland, where distances can be substantial. The market for HVDC cables is projected to grow by 15% annually, reflecting the increasing adoption of this technology. Additionally, the integration of smart technologies into cable systems is enhancing monitoring and maintenance capabilities, further driving market growth. These technological advancements are essential for meeting the evolving demands of the submarine power-cable market.

Rising Demand for Electrification of Remote Areas

The submarine power-cable market in Europe is seeing increased demand for electrifying remote and island communities. As governments prioritize energy access for all, the deployment of submarine cables to connect isolated regions to the main grid is becoming increasingly common. For example, projects aimed at connecting islands such as the Isles of Scilly to the mainland are underway, with investments projected to reach €50 million. This trend is expected to grow, as approximately 10% of the European population still lacks reliable access to electricity. The electrification of these areas not only enhances living standards but also promotes economic development, thereby driving the submarine power-cable market. The need for reliable and efficient cable solutions is paramount in these initiatives, positioning this driver as a key factor in market growth.

Growing Interconnectivity Between European Nations

The submarine power-cable market in Europe is significantly influenced by the growing interconnectivity between nations. As countries seek to enhance energy security and optimize resource sharing, the establishment of interconnectors is becoming increasingly vital. Projects such as the North Sea Wind Power Hub aim to connect multiple countries through a network of submarine cables, facilitating the exchange of renewable energy. This initiative could potentially provide up to 70 GW of electricity, thereby reducing reliance on fossil fuels. The European Commission has allocated substantial funding for these interconnector projects, with investments expected to exceed €1 billion by 2025. This trend towards interconnectivity not only strengthens energy resilience but also drives the demand for submarine power cables, making it a crucial market driver.