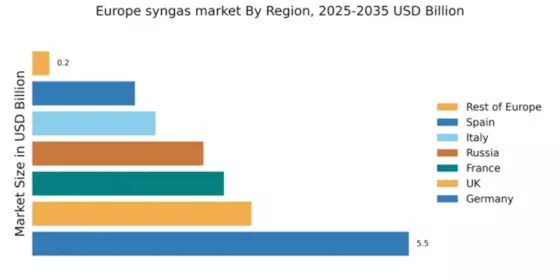

Germany : Strong industrial base drives growth

Germany holds a dominant market share of 5.5% in the European syngas sector, valued at approximately €2.5 billion. Key growth drivers include a robust industrial base, increasing demand for clean energy solutions, and government initiatives promoting hydrogen production. Regulatory policies favoring sustainable practices and investments in infrastructure, such as pipelines and gasification plants, further enhance market potential. The shift towards decarbonization is also influencing consumption patterns, with a growing focus on renewable syngas production.

UK : Government support fuels innovation

The UK accounts for a 3.2% share of the European syngas market, valued at around €1.4 billion. Growth is driven by government support for low-carbon technologies and increasing investments in renewable energy projects. Demand trends indicate a rising interest in syngas for power generation and transportation fuels. Regulatory frameworks, such as the UK’s Net Zero Strategy, are encouraging the development of syngas facilities, while infrastructure improvements are facilitating market access.

France : Industrial growth supports market expansion

France holds a 2.8% share of the European syngas market, valued at approximately €1.2 billion. The market is driven by diverse applications in chemicals, energy, and transportation sectors. Government initiatives aimed at reducing carbon emissions and promoting renewable energy sources are pivotal. The French government is investing in infrastructure to support syngas production, including biogas facilities and carbon capture technologies, which are reshaping consumption patterns.

Russia : Natural resources drive market growth

Russia's syngas market represents 2.5% of the European total, valued at around €1.1 billion. The country benefits from abundant natural resources, which are key growth drivers. Demand for syngas is increasing in the petrochemical sector, supported by government policies aimed at enhancing energy security. Major investments in infrastructure, including gas processing plants, are underway, fostering a competitive landscape with local players like Gazprom leading the market.

Italy : Focus on sustainability and innovation

Italy captures a 1.8% share of the European syngas market, valued at approximately €800 million. The market is driven by a focus on sustainability and innovation in energy production. Government initiatives promoting renewable energy and carbon neutrality are influencing demand trends. Key cities like Milan and Turin are emerging as hubs for syngas applications, particularly in transportation and industrial sectors, supported by local players such as Eni and Snam.

Spain : Renewable energy initiatives boost demand

Spain holds a 1.5% share of the European syngas market, valued at around €650 million. The growth is fueled by increasing interest in renewable energy solutions and government policies promoting green technologies. Demand for syngas in the agricultural and energy sectors is on the rise, with significant investments in infrastructure to support production. Key regions like Catalonia and Andalusia are leading the way, with major players like Repsol actively participating in the market.

Rest of Europe : Diverse opportunities across regions

The Rest of Europe accounts for a modest 0.25% share of the syngas market, valued at approximately €100 million. This sub-region presents niche opportunities driven by local initiatives and specific industrial needs. Demand trends vary significantly, with some countries focusing on syngas for waste-to-energy applications. The competitive landscape is fragmented, with smaller players and local initiatives gaining traction. Regulatory support for sustainable practices is essential for market growth.

Leave a Comment