Government Policies and Incentives

The Heavy Duty Gas Turbine Market is significantly shaped by government policies and incentives aimed at promoting cleaner energy solutions. Many governments are implementing regulations that favor the use of natural gas as a transitional fuel in the shift towards a low-carbon economy. Incentives such as tax breaks, subsidies, and grants for the installation of gas turbine systems are becoming increasingly common. These policies not only encourage investment in heavy duty gas turbines but also support the development of infrastructure necessary for their deployment. Recent reports indicate that regions with favorable regulatory frameworks are witnessing accelerated growth in gas turbine installations. This trend suggests that government actions play a crucial role in driving the adoption of heavy duty gas turbines, thereby influencing market dynamics.

Integration of Renewable Energy Sources

The Heavy Duty Gas Turbine Market is witnessing a notable trend towards the integration of renewable energy sources. As nations strive to meet ambitious carbon reduction targets, the role of gas turbines in complementing renewable energy generation becomes increasingly significant. Heavy duty gas turbines can provide the necessary backup power during periods of low renewable output, thus ensuring grid stability. This hybrid approach not only enhances energy security but also facilitates a smoother transition to a more sustainable energy landscape. Market data indicates that the share of gas turbines in the energy mix is expected to rise, particularly in regions investing heavily in wind and solar power. This trend underscores the versatility of heavy duty gas turbines in adapting to evolving energy demands while supporting the integration of cleaner energy sources.

Rising Industrialization and Urbanization

The Heavy Duty Gas Turbine Market is experiencing growth driven by rising industrialization and urbanization. As countries develop, the demand for energy to support industrial activities and urban infrastructure increases significantly. Heavy duty gas turbines are well-suited for meeting the energy needs of large-scale industrial operations, including manufacturing and processing plants. Additionally, urban areas require reliable power sources to support residential and commercial activities. Market data indicates that regions undergoing rapid urbanization are likely to see a corresponding increase in the installation of heavy duty gas turbines. This trend highlights the critical role that these turbines play in supporting economic growth and development, making them an essential component of the energy landscape.

Technological Innovations in Turbine Design

The Heavy Duty Gas Turbine Market is significantly influenced by ongoing technological innovations in turbine design. Advances in materials science, aerodynamics, and combustion technology are leading to the development of more efficient and powerful gas turbines. These innovations not only enhance performance but also reduce operational costs and emissions. For instance, the introduction of advanced cooling techniques and improved blade designs has resulted in turbines that can operate at higher temperatures and pressures, thereby increasing their efficiency. Market analysts suggest that these technological advancements could lead to a reduction in the levelized cost of electricity generated by gas turbines, making them even more competitive against other energy sources. As a result, the demand for state-of-the-art heavy duty gas turbines is likely to rise, further propelling market growth.

Increasing Demand for Reliable Power Generation

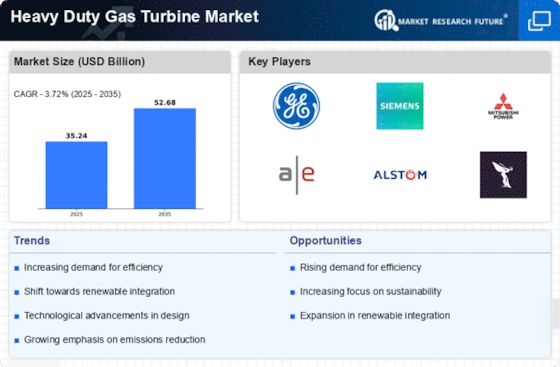

The Heavy Duty Gas Turbine Market is experiencing a surge in demand for reliable and efficient power generation solutions. As energy consumption continues to rise, particularly in developing regions, the need for robust power generation systems becomes paramount. Heavy duty gas turbines, known for their high efficiency and low emissions, are increasingly favored by utilities and industrial users. According to recent data, the market for heavy duty gas turbines is projected to grow at a compound annual growth rate of approximately 4.5% over the next several years. This growth is driven by the need for stable energy supply, especially in areas prone to power shortages. Furthermore, the ability of these turbines to operate on various fuels enhances their appeal, making them a preferred choice in the energy sector.

Leave a Comment