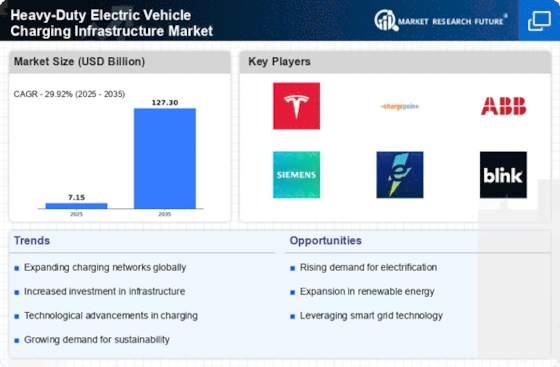

The Heavy-Duty Electric Vehicle Charging Infrastructure Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for sustainable transportation solutions and the global push towards electrification. Key players such as Tesla (US), ChargePoint (US), and ABB (CH) are at the forefront, each adopting distinct strategies to enhance their market positioning. Tesla (US) continues to innovate with its proprietary Supercharger network, focusing on expanding its infrastructure to support its growing fleet of electric trucks. ChargePoint (US), on the other hand, emphasizes partnerships with fleet operators to provide tailored charging solutions, thereby enhancing its service offerings. ABB (CH) is leveraging its technological expertise to develop high-power charging solutions, which are crucial for heavy-duty vehicles, thus positioning itself as a leader in this niche market. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological advancement and customer-centric solutions. In terms of business tactics, companies are localizing manufacturing to reduce costs and improve supply chain efficiency. This approach is particularly relevant in the context of rising material costs and geopolitical uncertainties. The market structure appears moderately fragmented, with several players vying for market share, yet dominated by a few key companies that hold significant technological advantages. The collective influence of these major players shapes the market dynamics, as they set benchmarks for innovation and service quality. In August 2025, Electrify America (US) announced a strategic partnership with a major logistics company to deploy a network of high-speed charging stations specifically designed for heavy-duty electric trucks. This initiative is pivotal as it not only expands Electrify America's footprint but also addresses the critical need for reliable charging infrastructure in the logistics sector, which is essential for the widespread adoption of electric heavy-duty vehicles. The partnership underscores the importance of collaboration in overcoming infrastructure challenges. In September 2025, Siemens (DE) unveiled its latest generation of charging technology, which includes advanced software for optimizing charging times based on grid demand. This development is significant as it aligns with the growing emphasis on sustainability and energy efficiency, allowing fleet operators to minimize operational costs while maximizing uptime. Siemens' focus on integrating smart technology into its charging solutions positions it favorably in a market that increasingly values digital transformation. In October 2025, Shell Recharge (GB) launched a new initiative aimed at enhancing the accessibility of charging stations in urban areas, particularly targeting fleet operators. This move is strategically important as it addresses the urbanization trend and the need for convenient charging solutions for heavy-duty vehicles. By focusing on urban infrastructure, Shell Recharge is likely to capture a growing segment of the market that prioritizes accessibility and convenience. As of October 2025, the competitive trends in the Heavy-Duty Electric Vehicle Charging Infrastructure Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their service offerings and technological capabilities. Looking ahead, competitive differentiation is expected to evolve from traditional price-based competition towards a focus on innovation, advanced technology, and supply chain reliability. This shift suggests that companies that prioritize these aspects will likely emerge as leaders in the market.