Rising Cybersecurity Concerns

The telecom analytics market in Europe is increasingly shaped by rising cybersecurity concerns. With the growing frequency of cyber threats, telecom operators are compelled to invest in analytics solutions that enhance their security posture. By analyzing network data, operators can detect anomalies and potential security breaches in real-time. In 2025, it is anticipated that spending on cybersecurity analytics within the telecom sector will exceed €1 billion, highlighting the urgency of addressing these threats. This focus on cybersecurity not only protects sensitive customer data but also reinforces trust in telecom services, thereby driving growth in the telecom analytics market.

Integration of IoT Technologies

The integration of Internet of Things (IoT) technologies significantly influences the telecom analytics market in Europe. As IoT devices proliferate, telecom operators are compelled to adopt analytics solutions that can manage and interpret the data generated by these devices. In 2025, it is estimated that there will be over 1 billion connected IoT devices in Europe, creating an immense volume of data that requires sophisticated analytics for effective management. This trend not only enhances operational efficiency but also enables telecom companies to develop innovative services and products tailored to the evolving needs of consumers. Consequently, the integration of IoT technologies is a critical driver for growth in the telecom analytics market.

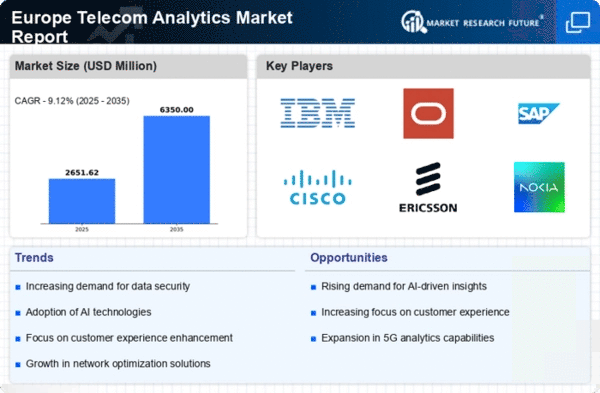

Growing Demand for Data-Driven Insights

The telecom analytics market in Europe experiences a notable surge in demand for data-driven insights. As telecom operators strive to enhance operational efficiency and customer satisfaction, the need for advanced analytics solutions becomes increasingly apparent. In 2025, the market is projected to reach approximately €3 billion, reflecting a compound annual growth rate (CAGR) of around 15% from previous years. This growth is primarily driven by the necessity to analyze vast amounts of data generated by mobile and fixed-line networks. By leveraging analytics, telecom companies can identify trends, optimize network performance, and tailor services to meet customer needs, thereby solidifying their competitive edge in the telecom analytics market.

Increased Focus on Network Optimization

The telecom analytics market in Europe is significantly impacted by the increased focus on network optimization. As competition intensifies, telecom operators are prioritizing the enhancement of network performance to ensure seamless connectivity and service delivery. By employing advanced analytics, operators can monitor network traffic, identify bottlenecks, and predict potential failures. This proactive approach is expected to reduce operational costs by up to 20% while improving customer satisfaction. In 2025, the market for network optimization analytics is projected to account for a substantial share of the overall telecom analytics market, reflecting the critical need for efficient network management.

Regulatory Pressures and Compliance Needs

The telecom analytics market in Europe is influenced by regulatory pressures and compliance needs. As governments implement stricter regulations regarding data privacy and protection, telecom operators must adopt analytics solutions that ensure compliance. This necessity is particularly pronounced with the General Data Protection Regulation (GDPR), which mandates stringent data handling practices. In 2025, compliance-related analytics solutions are expected to constitute a significant portion of the telecom analytics market, as operators seek to avoid hefty fines and reputational damage. Consequently, the emphasis on regulatory compliance serves as a vital driver for growth in the telecom analytics market.

Leave a Comment