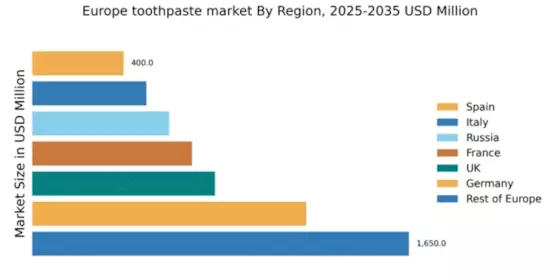

Germany : Strong Demand and Innovation Drive Growth

Germany holds a significant market share of 24% in the European toothpaste market, valued at $1,200.0 million. Key growth drivers include a rising awareness of oral hygiene and an increasing preference for premium products. Demand trends show a shift towards natural and organic toothpaste options, supported by government initiatives promoting health and wellness. The country benefits from robust infrastructure and a well-established distribution network, facilitating product availability across urban and rural areas.

UK : Consumer Trends Shape Product Offerings

The UK accounts for 16% of the European toothpaste market, valued at $800.0 million. Growth is fueled by increasing health consciousness and a shift towards eco-friendly products. Consumers are increasingly opting for specialized toothpaste, such as whitening and sensitivity formulas. Regulatory policies encourage the use of safe ingredients, while local initiatives promote oral health education. The market is characterized by a mix of traditional and online retail channels, enhancing accessibility.

France : Focus on Quality and Sustainability

France represents 14% of the European toothpaste market, valued at $700.0 million. The growth is driven by a strong emphasis on quality and sustainability, with consumers favoring brands that offer natural ingredients. Demand for premium and specialized products is on the rise, supported by government regulations promoting health standards. The market is bolstered by a well-developed retail sector, including pharmacies and supermarkets, which cater to diverse consumer needs.

Russia : Increasing Demand for Oral Care Products

Russia holds a 12% share of the European toothpaste market, valued at $600.0 million. The market is experiencing growth due to rising disposable incomes and a growing awareness of oral hygiene. Demand trends indicate a preference for affordable yet effective products. Government initiatives aimed at improving public health are also contributing to market expansion. The competitive landscape includes both local and international players, with major cities like Moscow and St. Petersburg being key markets.

Italy : Traditional Values Meet Modern Trends

Italy accounts for 10% of the European toothpaste market, valued at $500.0 million. The market is driven by a blend of traditional values and modern consumer preferences, with a growing interest in natural and organic products. Regulatory policies support the use of safe ingredients, while local initiatives promote oral health awareness. Key markets include Milan and Rome, where competition is fierce among established brands and new entrants, creating a dynamic business environment.

Spain : Consumer Awareness Drives Product Demand

Spain represents 8% of the European toothpaste market, valued at $400.0 million. The growth is attributed to increasing consumer awareness regarding oral health and hygiene. Demand trends show a preference for products that offer additional benefits, such as whitening and sensitivity relief. Government initiatives aimed at promoting dental health are also influencing market dynamics. Major cities like Madrid and Barcelona are key markets, with a competitive landscape featuring both local and international brands.

Rest of Europe : Varied Preferences Across Regions

The Rest of Europe holds the largest market share at 33%, valued at $1,650.0 million. This diverse market is characterized by varying consumer preferences and regulatory environments. Growth drivers include increasing health awareness and a shift towards natural products. Local initiatives and government policies play a crucial role in shaping market dynamics. Key markets include Scandinavia and Eastern Europe, where competition is marked by both established brands and emerging players.