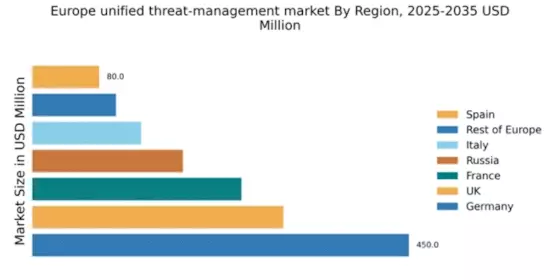

Germany : Robust Infrastructure Drives Growth

Germany holds a dominant position in the European unified threat-management market, with a market value of $450.0 million, representing approximately 36% of the total market share. Key growth drivers include a strong emphasis on data protection regulations, such as the GDPR, and increasing cyber threats prompting businesses to invest in advanced security solutions. The demand for integrated security systems is rising, supported by government initiatives promoting digital transformation and cybersecurity awareness. Additionally, Germany's well-developed IT infrastructure and industrial base further enhance market growth.

UK : Innovation Fuels Market Expansion

The UK unified threat-management market is valued at $300.0 million, accounting for 24% of the European market share. The growth is driven by increasing cyber threats and a shift towards cloud-based security solutions. Demand for advanced threat detection and response systems is on the rise, supported by government initiatives like the National Cyber Security Strategy. The UK also benefits from a vibrant tech ecosystem, fostering innovation and collaboration among cybersecurity firms.

France : Regulatory Support Enhances Growth

France's unified threat-management market is valued at $250.0 million, representing 20% of the European market share. The growth is propelled by stringent data protection laws and a focus on enhancing national cybersecurity capabilities. Demand for comprehensive security solutions is increasing, particularly in sectors like finance and healthcare. Government initiatives, such as the Cybersecurity Strategy for the Nation, are fostering a supportive environment for cybersecurity investments.

Russia : Strategic Investments in Security

Russia's unified threat-management market is valued at $180.0 million, capturing 14% of the European market share. The market is driven by rising cyber threats and the need for robust security measures across various sectors. Government initiatives aimed at enhancing national cybersecurity infrastructure are also contributing to market growth. The demand for localized solutions is increasing, particularly in critical industries such as energy and telecommunications.

Italy : Regulatory Changes Drive Adoption

Italy's unified threat-management market is valued at $130.0 million, accounting for 10% of the European market share. The growth is fueled by regulatory changes and an increasing awareness of cybersecurity risks among businesses. Demand for integrated security solutions is rising, particularly in the manufacturing and retail sectors. Government initiatives, including the National Cybersecurity Strategy, are promoting investments in cybersecurity infrastructure and awareness programs.

Spain : Focus on Digital Transformation

Spain's unified threat-management market is valued at $80.0 million, representing 6% of the European market share. The market is experiencing growth driven by digital transformation initiatives and increasing cyber threats. Demand for advanced security solutions is rising, particularly in sectors like finance and healthcare. Government policies aimed at enhancing cybersecurity resilience are also playing a crucial role in market development.

Rest of Europe : Varied Market Dynamics Across Regions

The Rest of Europe unified threat-management market is valued at $100.0 million, accounting for 8% of the total market share. This sub-region encompasses a diverse range of countries, each with unique market dynamics and regulatory environments. Growth is driven by increasing awareness of cybersecurity risks and the need for compliance with EU regulations. Demand for localized solutions is rising, particularly in sectors like finance and healthcare, as businesses seek to enhance their security posture.