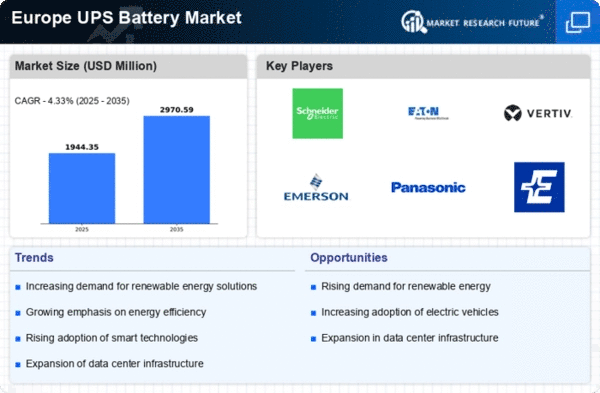

The ups battery market in Europe is characterized by a dynamic competitive landscape, driven by increasing demand for reliable power solutions across various sectors, including data centers, telecommunications, and renewable energy. Key players such as Schneider Electric (FR), Eaton (US), and Vertiv (US) are strategically positioned to leverage innovation and sustainability initiatives. Schneider Electric (FR) focuses on digital transformation and energy management solutions, while Eaton (US) emphasizes its commitment to sustainability through eco-friendly product offerings. Vertiv (US) is enhancing its operational focus on critical infrastructure, which collectively shapes a competitive environment that prioritizes technological advancement and environmental responsibility.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several key players exerting influence over their respective segments. This fragmentation allows for niche players to thrive, while larger corporations consolidate their market share through strategic partnerships and acquisitions, thereby enhancing their competitive positioning.

In October 2025, Schneider Electric (FR) announced a partnership with a leading renewable energy provider to develop integrated energy storage solutions. This strategic move is likely to enhance Schneider's portfolio, aligning with the growing trend towards sustainable energy solutions. By integrating energy storage with renewable sources, the company positions itself as a leader in the transition towards greener technologies, potentially increasing its market share in the ups battery segment.

In September 2025, Eaton (US) launched a new line of lithium-ion batteries designed for high-performance applications. This product introduction not only reflects Eaton's commitment to innovation but also addresses the increasing demand for efficient and long-lasting power solutions. The strategic importance of this launch lies in Eaton's ability to cater to the evolving needs of customers seeking reliable and sustainable energy storage options, thereby reinforcing its competitive edge in the market.

In August 2025, Vertiv (US) expanded its operations in Eastern Europe by establishing a new manufacturing facility. This expansion is indicative of Vertiv's strategy to enhance its production capabilities and meet the rising demand for ups systems in the region. By localizing production, Vertiv aims to improve supply chain efficiency and reduce costs, which could significantly bolster its competitive position in the European market.

As of November 2025, current competitive trends in the ups battery market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are increasingly shaping the landscape, enabling companies to pool resources and expertise to drive innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to changing market demands.