Shift in Consumer Behavior

Consumer behavior in Europe is shifting towards on-demand viewing, significantly impacting the video on-demand market. A recent survey indicates that over 60% of European consumers prefer watching content on their own schedule rather than adhering to traditional broadcast times. This shift is partly driven by the increasing availability of diverse content libraries, which cater to various tastes and preferences. Additionally, the rise of binge-watching culture has led to a demand for entire seasons of shows to be available at once. As a result, video on-demand platforms are adapting their strategies to meet these evolving consumer expectations, which is likely to enhance their market share.

Competitive Pricing Strategies

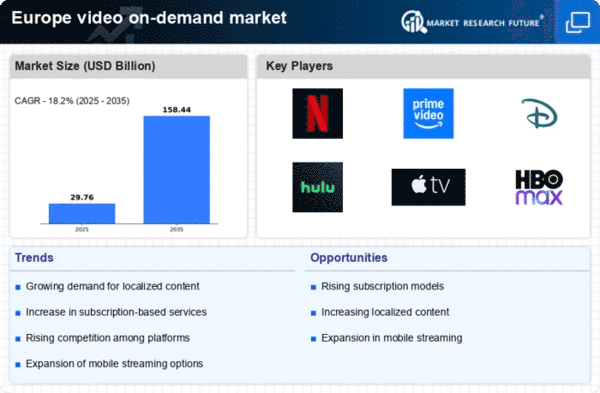

Pricing strategies play a crucial role in the video on-demand market in Europe. With numerous platforms vying for consumer attention, competitive pricing has become a key driver. Many services are adopting subscription models that offer tiered pricing, allowing consumers to choose plans that best fit their viewing habits. For instance, platforms may offer basic packages at €5 per month, while premium options could reach €15 per month, providing access to exclusive content. This pricing flexibility is likely to attract a broader audience, including price-sensitive consumers, thereby expanding the overall market. As of 2025, the average revenue per user in the video on-demand market is projected to increase by 10%.

Rise of Mobile and Smart Devices

The proliferation of mobile and smart devices is a significant driver of the video on-demand market in Europe. As of 2025, it is estimated that over 80% of video content is consumed on mobile devices, reflecting a shift in viewing habits. The convenience of accessing content on smartphones, tablets, and smart TVs allows consumers to watch their favorite shows anytime, anywhere. This trend is further supported by the increasing affordability of mobile data plans, which encourages on-the-go viewing. Consequently, video on-demand platforms are optimizing their services for mobile users, which is likely to enhance user satisfaction and retention in the competitive landscape.

Technological Advancements in Streaming

The video on-demand market in Europe is experiencing a surge due to rapid technological advancements in streaming services. Innovations such as adaptive bitrate streaming and improved compression algorithms enhance user experience by providing high-quality video with minimal buffering. As of 2025, approximately 70% of European households have access to high-speed internet, facilitating seamless streaming. Furthermore, the integration of artificial intelligence in content recommendation systems is likely to increase user engagement, as personalized suggestions can lead to longer viewing times. This technological evolution not only attracts new subscribers but also retains existing ones, thereby driving revenue growth in the video on-demand market.

Regulatory Environment and Content Licensing

The regulatory environment in Europe significantly influences the video on-demand market. Stricter content licensing laws and regulations regarding copyright protection are shaping how platforms operate. For instance, the European Union's Digital Services Act aims to create a safer online environment, which may impose additional compliance costs on video on-demand providers. However, these regulations also encourage platforms to invest in original content, as they seek to differentiate themselves in a crowded market. As a result, the focus on local content production is likely to increase, potentially leading to a more diverse range of offerings that cater to regional audiences.