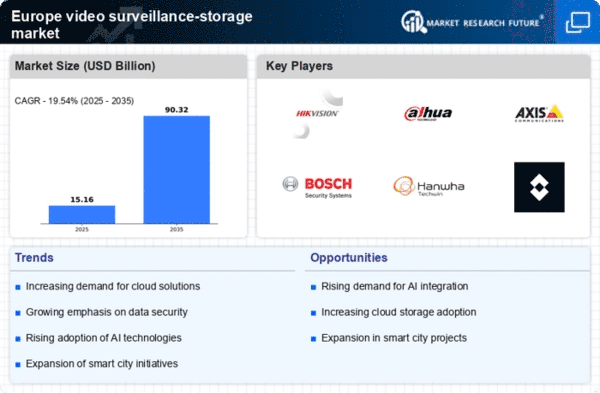

Growth of Smart Cities and Urban Development

The ongoing development of smart cities across Europe is fostering a favorable environment for the video surveillance-storage market. As urban areas become more interconnected, the need for comprehensive surveillance systems to monitor public spaces and enhance safety is becoming increasingly apparent. Investments in smart infrastructure are projected to exceed €100 billion by 2025, with a significant portion allocated to surveillance technologies. This trend is likely to drive demand for scalable storage solutions capable of handling vast amounts of data generated by numerous surveillance devices. Consequently, the video surveillance-storage market is expected to thrive as cities prioritize safety and efficiency.

Rising Demand for Enhanced Security Solutions

The increasing need for robust security measures across various sectors is driving the video surveillance-storage market in Europe. Organizations are investing heavily in surveillance systems to mitigate risks associated with theft, vandalism, and other criminal activities. In 2025, the market is projected to reach approximately €3 billion, reflecting a growth rate of around 10% annually. This demand is particularly pronounced in sectors such as retail, banking, and transportation, where the need for real-time monitoring and data storage is critical. As businesses recognize the importance of safeguarding assets and ensuring customer safety, the video surveillance-storage market is likely to experience sustained growth.

Increased Focus on Remote Monitoring Solutions

The shift towards remote monitoring solutions is reshaping the video surveillance-storage market in Europe. As businesses and organizations seek to enhance operational efficiency, the demand for remote access to surveillance footage is growing. This trend is particularly relevant in sectors such as logistics, healthcare, and education, where real-time monitoring is essential. By 2025, it is estimated that remote monitoring solutions will account for approximately 30% of the total market share. This shift not only necessitates advanced storage solutions but also drives innovation in cloud-based technologies, enabling users to access and manage surveillance data seamlessly from various locations.

Regulatory Compliance and Data Protection Laws

The stringent regulatory landscape in Europe is a significant driver for the video surveillance-storage market. With the implementation of laws such as the General Data Protection Regulation (GDPR), organizations are compelled to adopt compliant surveillance solutions that ensure data privacy and security. This regulatory pressure is leading to increased investments in secure storage systems that can handle sensitive information responsibly. By 2025, it is anticipated that compliance-related expenditures will account for nearly 15% of total surveillance budgets. As businesses navigate these legal requirements, the demand for compliant video surveillance-storage solutions is likely to rise, shaping the market's trajectory.

Technological Advancements in Surveillance Equipment

The rapid evolution of surveillance technology is significantly impacting the video surveillance-storage market in Europe. Innovations such as high-definition cameras, advanced motion detection, and integrated analytics are enhancing the capabilities of surveillance systems. These advancements not only improve the quality of video footage but also facilitate more efficient data storage solutions. In 2025, it is estimated that the adoption of AI-driven analytics will increase by 25%, further driving the demand for sophisticated storage solutions. As organizations seek to leverage these technologies for better security outcomes, the market is expected to expand, with a focus on integrating cutting-edge equipment.