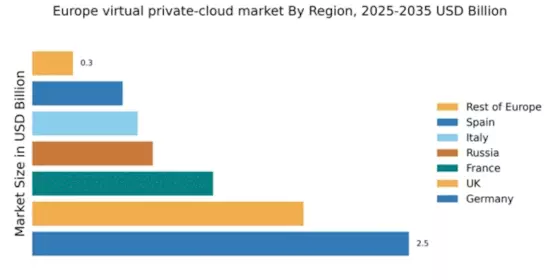

Germany : Strong Infrastructure and Innovation Hub

Germany holds a commanding 2.5% market share in the virtual private-cloud sector, driven by robust demand for digital transformation across industries. Key growth drivers include government initiatives promoting cloud adoption, stringent data protection regulations, and a strong emphasis on cybersecurity. The country’s advanced infrastructure, including high-speed internet and data centers, supports increasing consumption patterns, particularly in sectors like finance and manufacturing.

UK : Innovation and Financial Services Powerhouse

The UK boasts a 1.8% market share in the virtual private-cloud market, fueled by a vibrant tech ecosystem and a strong financial services sector. Demand is driven by the need for scalable solutions and compliance with GDPR regulations. The government actively supports cloud initiatives, enhancing infrastructure and fostering innovation, particularly in cities like London and Manchester, which are tech hubs.

France : Government Support and Tech Growth

France captures a 1.2% market share in the virtual private-cloud landscape, with growth propelled by government initiatives aimed at boosting digital transformation. The French Tech initiative encourages startups and innovation, while regulatory frameworks ensure data sovereignty. Demand is rising in sectors like healthcare and retail, where cloud solutions enhance operational efficiency and customer engagement.

Russia : Growing Demand Amid Challenges

Russia holds a 0.8% market share in the virtual private-cloud market, with growth driven by increasing digitalization across various sectors. Government policies promoting local data storage and cybersecurity are key factors. Major cities like Moscow and St. Petersburg are central to cloud adoption, with local players emerging alongside global giants, creating a competitive landscape that is evolving rapidly.

Italy : Cultural Shift Towards Digital Solutions

Italy's virtual private-cloud market accounts for 0.7%, with growth spurred by a cultural shift towards digital solutions in businesses. Government incentives for digital transformation and investments in infrastructure are pivotal. Key markets include Milan and Rome, where major players like AWS and Microsoft Azure are establishing a strong presence, catering to sectors such as fashion and automotive.

Spain : Tech Adoption and Regulatory Support

Spain captures a 0.6% market share in the virtual private-cloud sector, driven by increasing tech adoption and supportive regulatory frameworks. The Spanish government promotes cloud initiatives to enhance competitiveness, particularly in cities like Barcelona and Madrid. The competitive landscape features both local and international players, focusing on sectors like tourism and e-commerce.

Rest of Europe : Varied Growth and Opportunities

The Rest of Europe holds a 0.27% market share in the virtual private-cloud market, characterized by diverse growth patterns across different countries. Regulatory environments vary, influencing cloud adoption rates. Emerging markets in Eastern Europe are witnessing increased investment in cloud infrastructure, while established markets focus on compliance and security, creating unique opportunities for service providers.