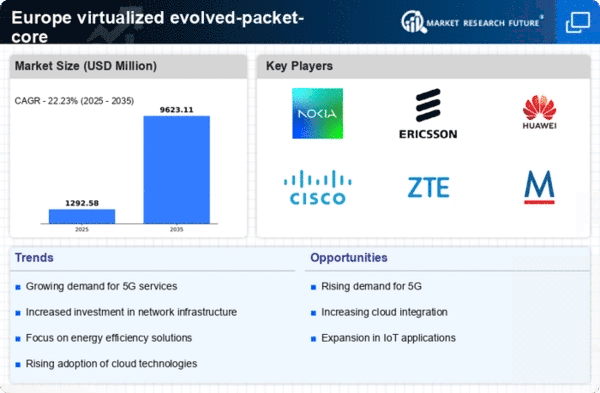

The virtualized evolved-packet-core market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for efficient network management and the transition towards 5G technologies. Key players such as Nokia (FI), Ericsson (SE), and Huawei (CN) are at the forefront, each adopting distinct strategies to enhance their market positioning. Nokia (FI) emphasizes innovation through its investments in cloud-native solutions, while Ericsson (SE) focuses on strategic partnerships to bolster its service offerings. Huawei (CN), on the other hand, leverages its extensive R&D capabilities to maintain a competitive edge, particularly in emerging markets. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological advancement and customer-centric solutions.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure appears moderately fragmented, with several players vying for market share. This fragmentation allows for a diverse range of offerings, yet the influence of major players remains substantial, shaping industry standards and customer expectations.

In October 2025, Nokia (FI) announced a strategic partnership with a leading European telecom operator to deploy its latest cloud-native core network solutions. This collaboration is expected to enhance network performance and scalability, positioning Nokia as a key enabler of 5G services in the region. The strategic importance of this partnership lies in its potential to accelerate the adoption of advanced network technologies, thereby reinforcing Nokia's market presence.

In September 2025, Ericsson (SE) unveiled its new AI-driven network management platform, aimed at optimizing network operations for telecom providers. This innovation is significant as it aligns with the growing trend of digital transformation within the industry, enabling operators to enhance service delivery and reduce operational costs. By integrating AI capabilities, Ericsson is likely to strengthen its competitive advantage in the evolving market landscape.

In August 2025, Huawei (CN) launched a new suite of virtualized core network solutions tailored for small and medium-sized enterprises (SMEs). This move is particularly noteworthy as it addresses the specific needs of SMEs, a segment that has been historically underserved. By targeting this market, Huawei may expand its customer base and drive further growth in the virtualized evolved-packet-core sector.

As of November 2025, current competitive trends are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need for collaboration to navigate the complexities of the market. Looking ahead, competitive differentiation is likely to evolve, shifting from price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition underscores the importance of agility and responsiveness in meeting the demands of a rapidly changing market.