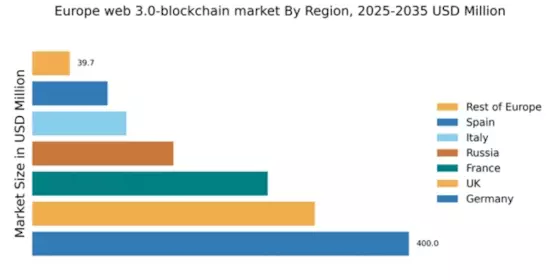

Germany : Innovation and Regulation Drive Growth

Germany holds a dominant market share of 400.0, representing approximately 40% of the European blockchain market. Key growth drivers include a robust regulatory framework, government support for digital innovation, and a strong tech infrastructure. Demand for blockchain solutions is rising in finance, supply chain, and healthcare, with initiatives like the Blockchain Strategy of the Federal Government promoting adoption and investment in the sector. The country’s advanced industrial base further supports blockchain integration across various sectors.

UK : Financial Services Lead Adoption

The UK boasts a market value of 300.0, accounting for about 30% of Europe's blockchain landscape. The financial services sector is a primary growth driver, with increasing demand for decentralized finance (DeFi) solutions. Regulatory clarity from the Financial Conduct Authority (FCA) has encouraged investment, while London remains a key hub for blockchain startups and innovation. The UK government is also exploring digital currency initiatives, further enhancing market dynamics.

France : Government Support Fuels Innovation

France's blockchain market is valued at 250.0, representing 25% of the European total. The French government has implemented favorable regulations, such as the PACTE law, to stimulate blockchain adoption across various industries. Demand is particularly strong in logistics and finance, with Paris emerging as a key center for blockchain startups. Major players like Tezos are headquartered here, contributing to a competitive landscape that fosters innovation and collaboration.

Russia : Emerging Market with Unique Challenges

With a market value of 150.0, Russia's blockchain sector is growing steadily, driven by increasing interest in cryptocurrencies and decentralized applications. Government initiatives, such as the Digital Economy Program, aim to enhance blockchain infrastructure. However, regulatory uncertainties pose challenges. Key cities like Moscow and St. Petersburg are at the forefront of blockchain development, with local players and international firms vying for market share in sectors like finance and logistics.

Italy : Cultural Heritage Meets Technology

Italy's blockchain market is valued at 100.0, representing a growing interest in digital solutions. Key growth drivers include the integration of blockchain in supply chain management and cultural heritage preservation. The Italian government is actively promoting blockchain through initiatives like the National Strategy for Blockchain. Cities like Milan and Rome are emerging as innovation hubs, attracting both local and international players in the blockchain space.

Spain : Diverse Applications Drive Growth

Spain's blockchain market is valued at 80.0, with significant growth potential across various sectors. The demand for blockchain solutions in real estate, finance, and public administration is rising, supported by government initiatives aimed at digital transformation. Cities like Barcelona and Madrid are key markets, hosting numerous blockchain startups and events. The competitive landscape includes both local firms and international players, fostering a vibrant ecosystem.

Rest of Europe : Diverse Growth Across Regions

The Rest of Europe holds a market value of 39.74, reflecting a diverse range of blockchain initiatives across smaller nations. Growth drivers include local government support and increasing interest in digital currencies. Countries like Switzerland and Estonia are notable for their progressive regulatory environments, attracting blockchain investments. The competitive landscape is characterized by a mix of local startups and established players, each contributing to sector-specific applications in finance and logistics.